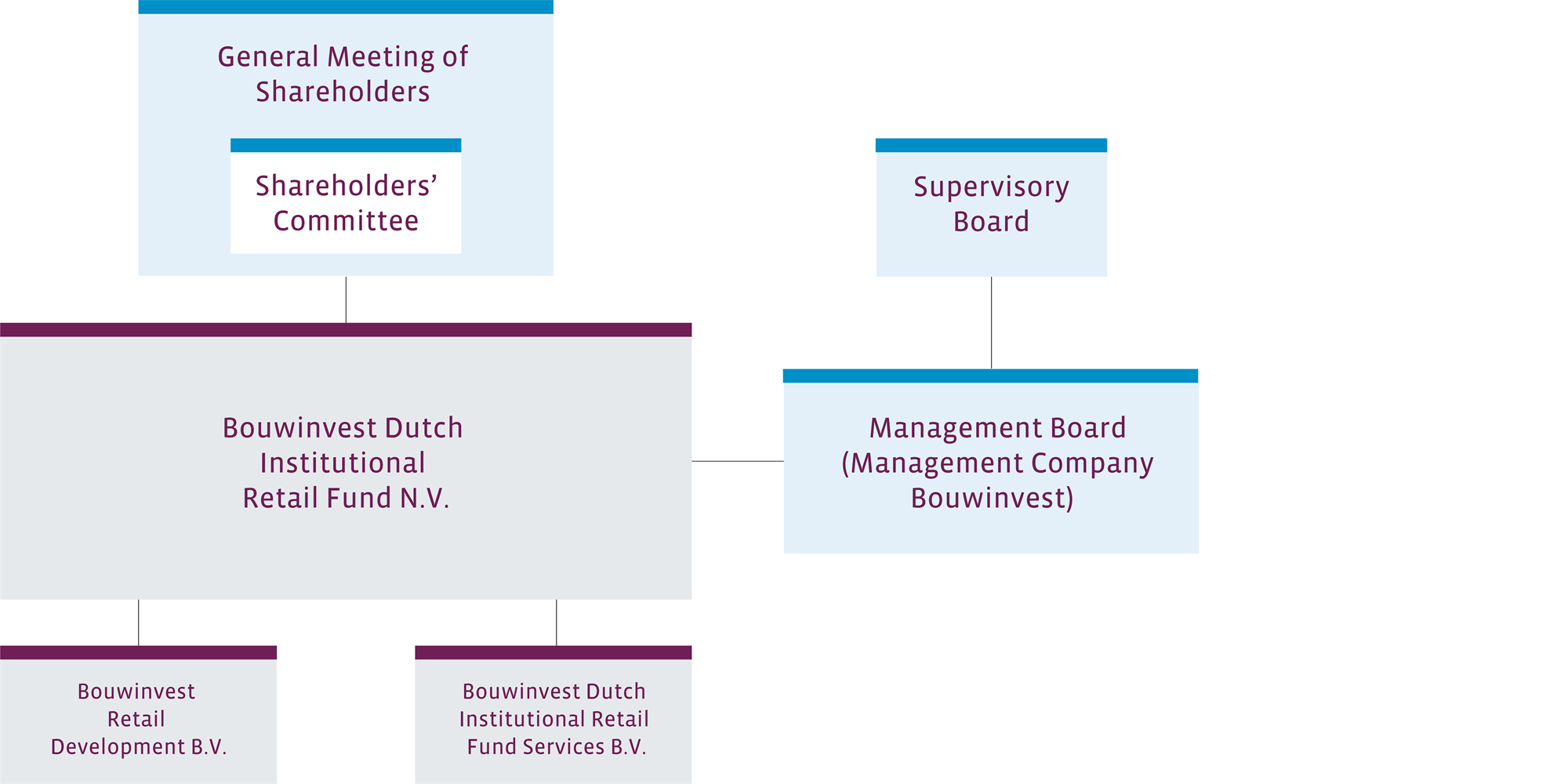

The Fund is structured as an investment company with variable capital, as defined in article 2:76a of the Dutch Civil Code, with its corporate seat in Amsterdam, the Netherlands. It is a fiscal investment institution (FII) within the meaning of Article 28 of the Dutch Corporate Income Tax Act 1969. Bouwinvest Real Estate Investors B.V. (“Bouwinvest”) is the Fund's Statutory Director and management company pursuant to the management agreement. The management company has a licence within the meaning of Article 2:65 of the Dutch Financial Supervision Act and is subject to supervision of the Dutch Financial Markets Authority (AFM).

Subsidiaries

The Fund has two taxable subsidiaries, Bouwinvest Dutch Institutional Retail Fund Services B.V., which renders services that are ancillary to the renting activities of the Fund, and Bouwinvest Retail Development B.V., which pursues development activities that are ancillary to the investment portfolio of the Fund . The activities are placed within these taxable subsidiaries to ensure the Fund’s compliance with the investment criteria of the FII regime.

Fund governance bodies

Shareholders' Committee

The Shareholders' Committee comprises a maximum of five shareholders: one representative from each of the four shareholders with the largest individual commitment and one member to represent the collective interests of all other shareholders. Each eligible shareholder shall appoint a member of the Shareholders' Committee for a period of one year, running from the annual general meeting.

Role of the Shareholders' Committee

The role of the Shareholders' Committee is to approve certain specified resolutions by the management company and to be consulted with regard to certain resolutions specified in the Terms and Conditions. The responsibility for proper performance of its duties is vested in the Shareholders' Committee collectively. In 2018, the Shareholders' Committee met once to discuss the Fund Plan.

General Meeting of Shareholders

The Retail Fund's shareholders must be professional institutional investors within the meaning of section 1:1 of the Dutch Financial Markets Supervision Act (FMSA). General Meetings of Shareholders are held at least once a year to discuss the annual report, adopt the financial statements and discharge the Statutory Director of the Fund for its management. Shareholder approval is required for the Fund Plan and for other resolutions pursuant to the Fund Documents.

Governance matrix

| | General Meeting of Shareholders | Shareholders' Committee |

| | Simple Majority vote (> 50%) | Double Majority vote | Approval rights | Consultation rights |

Amendment of the strategy of the Fund | | X | | X |

Liquidation, conversion, merger, demerger of the Fund | | X | | X |

Dismissal and replacement of the Management Company | | X | | X |

Amendment of the Management Fee of the Fund | | X | | X |

Conflict of Interest on the basis of the Dutch Civil Code | | X | | X |

Investments within the Hurdle Rate Bandwidth as specified in the Fund Plan | | | X | |

Related Party Transaction | | | X | |

Amendment or termination of the Fund Documents | X | | | X |

Adoption of the Fund plan | X | | | X |

Deviation from the valuation methodology of the Fund as set out in the Valuation Manual | X | | | X |

Investments outside the Hurdle Rate Bandwidth as specified in the Fund Plan | X | | | X |

Change of Control (of the Management Company) | | | | X |

Appointment, suspension and dismissal of managing directors of the Fund (with due observance to the rights mentioned under 3. here above). | X | | | X |

Amendment to the Articles of Association of the Fund | X | | | |

Adoption of the Accounts of the Fund | X | | | |

Information rights on the basis of the Dutch Civil Code | X | | | |

Authorising the management board to purchase own Shares | X | | | |

Reducing the capital of the Fund | X | | | |

Extending the five month term with regard to approval of the Accounts | X | | | |

Providing the management board with the authority to amend the Articles of Association of the Fund | X | | | |

Appointing a representative in the event of a Conflict of Interest | X | | | |

Requesting to investigate the Accounts and the withdrawal thereof | X | | | |

Approval of an Applicant Shareholder to become a Shareholder of the Fund | X | | | |

The rights of the General Meetings of Shareholders and the Shareholders' Committee are shown in the Governance Matrix.

Anchor investor

As at this annual report’s publication date, bpfBOUW held the majority of the shares in the Retail Fund.