The performance of the Fund is directly related to how Bouwinvest manages the risk inherent in the Fund to achieve its goal of stable long-term returns for its investors.

Bouwinvest is fully aware that it is investing on behalf of the investors in the Fund. It has therefore established a client-oriented organisation that creates value by investing with a clear view on real estate markets, and a corresponding risk management framework. Risk management is the process of understanding these risks for Bouwinvest and its investors; to manage these risks within the parameters of the defined appetite and tolerances through an efficient and effective system of risk controls; and monitoring and reporting on the effectiveness of same.

This risk framework requires a structured integrated approach to provide the Board of Directors with insight into the proper identification of risks; the risk and control measures (both substance and procedures) taken by line management to manage these risks; an independent assessment on the effectiveness of these measures and resulting remaining risks and advice or proposals to (further) reduce the risk based on a forward-looking approach. Bouwinvest has established a Risk Management Framework based on the COSO framework. This framework will establish risk policies for each identified material risk, describing risk appetite, risk processes and procedures with adequate control measures to manage these risks, together with defined and allocated roles and responsibilities.

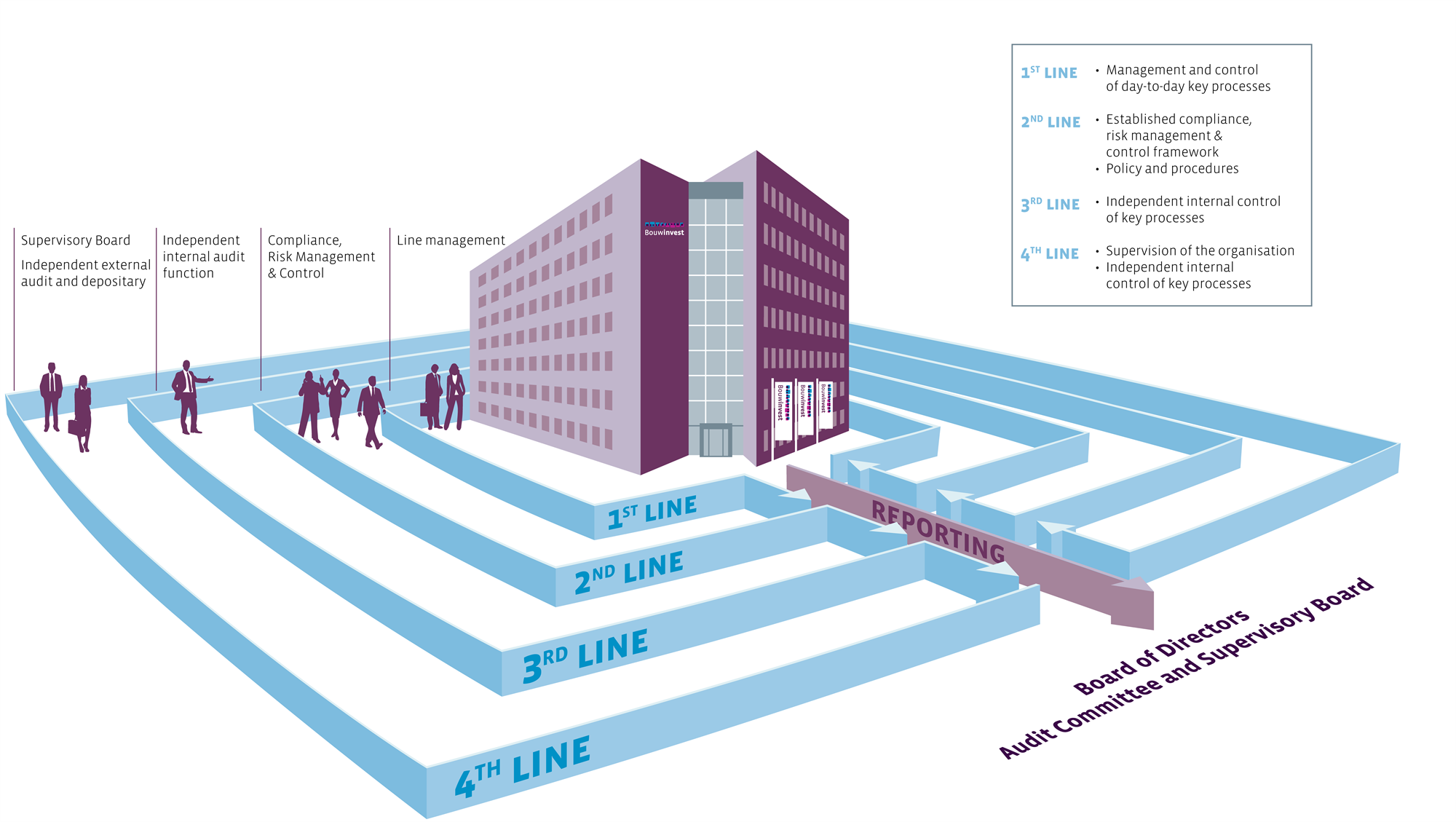

Lines of defence principle

The roles and responsibilities in the organisation with respect to risk management are based on the so-called lines of defense model, which together provides the Board of Directors with a framework that helps its members to be in control.

The lines of defence are as follows:

Line management – responsible for the integration of a risk and control environment in the daily activities of the organisation;

Compliance, Risk Management and Control – responsible for policy lines related to risks, compliance and control, and efficient and cost-effective implementation of said policy lines. Together with a process of continuous improvement;

Internal Auditor – ensures the integrity and functioning of the risk management framework and performs operational audits;

Supervisory Board and external auditor – the Supervisory Board supervises the risk assessments and risk management related to the strategy and activities of Bouwinvest and the functioning of the internal risk monitoring and control framework, while the external auditor provides its independent opinion.

Bouwinvest's lines of defence

Risk management

The Risk Management department plays a coordinating role to provide a holistic and integral overview of all risks within Bouwinvest and the risks within the Funds and mandates managed by Bouwinvest. Risk Management maintains a taxonomy of all identified risks relevant to Bouwinvest; designs and implements the overall risk policy and risk policies for each of these risks; and coordinates where risk policies are defined by other departments (such as Legal, Tax and Control). The primary role of the Risk Management department is to identify and assess all material risks, to define the probabilities and impact of risk scenarios and to perform a challenging, countervailing role with respect to timeliness, fairness and completeness; from a pre-event and post-event perspective; substance and procedural. The Risk Management department proposes improvements for risk mitigating measures and controls aligned to the Board's of Directors defined risk appetite for the organisation and or the Funds managed by Bouwinvest.

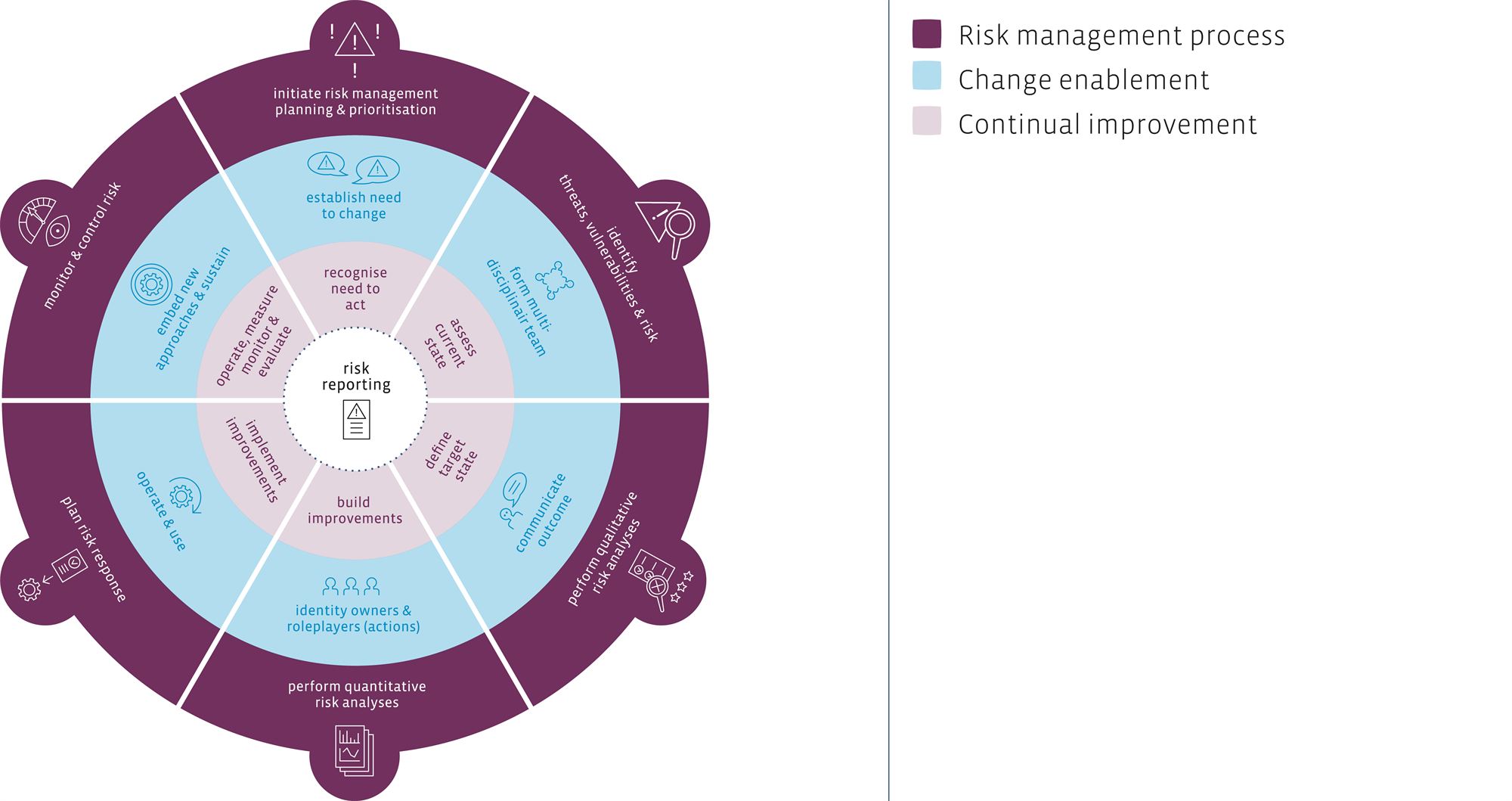

Risk management cycle

Risk Management uses a risk management cycle to determine the risk management objectives in which all material risks are within the Board's of Directors stated risk appetite.

Risk management execution

In the implementation of the risk management policies and controls, line management is supported and input is reviewed by dedicated and often independently positioned departments, such as Business Control and Research, especially during the investment decision-making process.

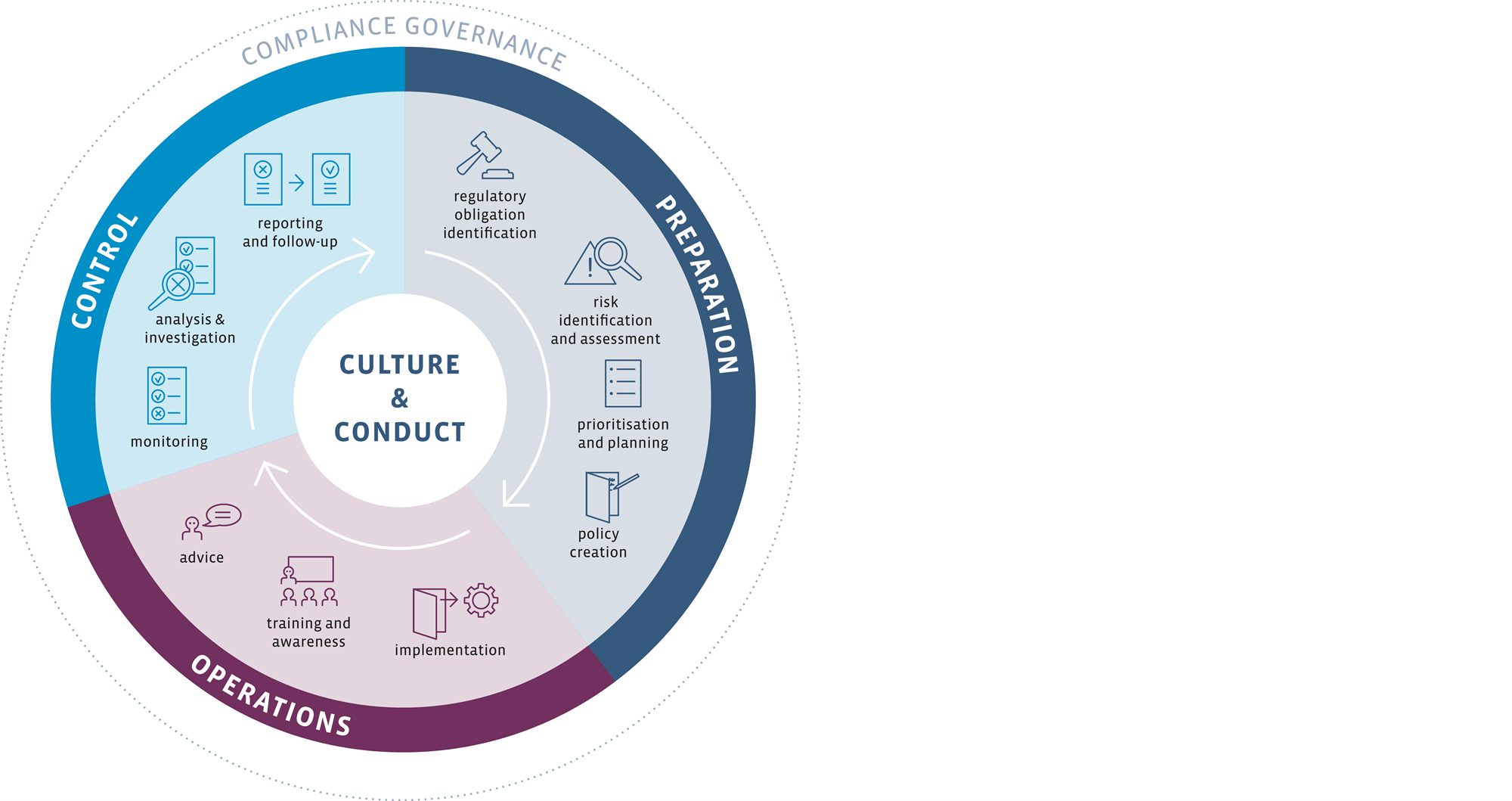

Compliance

Bouwinvest has a dedicated compliance function that identifies, assesses, advises on, monitors and reports on the company’s compliance risks. For the planning, execution and reporting of all compliance activities, Compliance employs the Bouwinvest Compliance Cycle. This cycle contains groups of activities that are vital for the compliance function. The first group of activities focuses on the identification and interpretation of existing and new legislation relevant to Bouwinvest and its stakeholders and to determine its impact. Bouwinvest subsequently identifies and assigns scores to the relevant compliance risks and, on the basis of same, determines priorities. Compliance then translates the (amended) legislation and identified risks into policies, and then implements same. To achieve this, Compliance facilitates the design of the processes, procedures and/or controls needed to execute the updated and new policies. During implementation and on an ongoing basis, Compliance devotes a great deal of effort to creating awareness and providing advice on relevant compliance risks and how to deal with them, ensuring a reduction in the number of incidents.

Bouwinvest’s compliance function supervises and monitors the effectiveness of the controls and initiates specific investigations when incidents or findings from regular monitoring activities necessitate this. Compliance reports on findings and on any areas of improvement in regular compliance reports, as well as reports on any investigations initiated.

The Bouwinvest Compliance Cycle

‘In control’ statement

The Bouwinvest Board of Directors has provided an ‘In control statement’, with respect to the risks related to Bouwinvest's financial reporting process and its strategic and operational risk management. The Board of Directors is responsible for an adequate risk management framework and well-functioning internal control systems, as well as the effectiveness thereof.

On the basis of its judgments of the risk management and internal control systems, the Board of Directors is of the opinion that these systems provide a reasonable assurance that the financial reports do not contain any material errors. Since 2012, Bouwinvest has received an annual ISAE3402 type II declaration showing that these processes are functioning as intended.