Our sustainable real estate strategy is built on two pillars: certified sustainable assets and the reduction of environmental impact. Sustainable real estate helps to combat climate change and generates broader social, economic, environmental and health benefits. We are convinced that our approach reduces risk, increases client returns and makes our real estate assets and portfolios more attractive.

Sustainable buildings

Sustainable building certificates enable us to show where we are in terms of sustainability at asset level and how far we still have to go. We use internationally accepted sustainability certificates to measure and assess the overall sustainability of our assets. Benchmarks help us to make informed business decisions to mitigate environmental, social and governance risks and enhance our long-term returns. Certificates such as GPR Building measure criteria that go beyond legislative requirements and provide us with instruments to encourage more responsible tenant behaviour, such as cutting waste and reducing energy consumption.

The Fund uses GPR Building software to measure and assess the overall sustainability of its buildings. The GPR reports on five performance indicators: Energy, Environment, Health, Quality of Use and Future value, and assigns a score for each performance indicator on a scale of 1 to 10. When used on existing buildings, GPR makes it very easy to identify potential quality improvements following sustainability-related measures. This in turn makes it very easy to compare various scenarios and the outcome of any measures, which enables us to choose the most (cost) effective measures, both in terms of sustainability and the long-term return on investment.

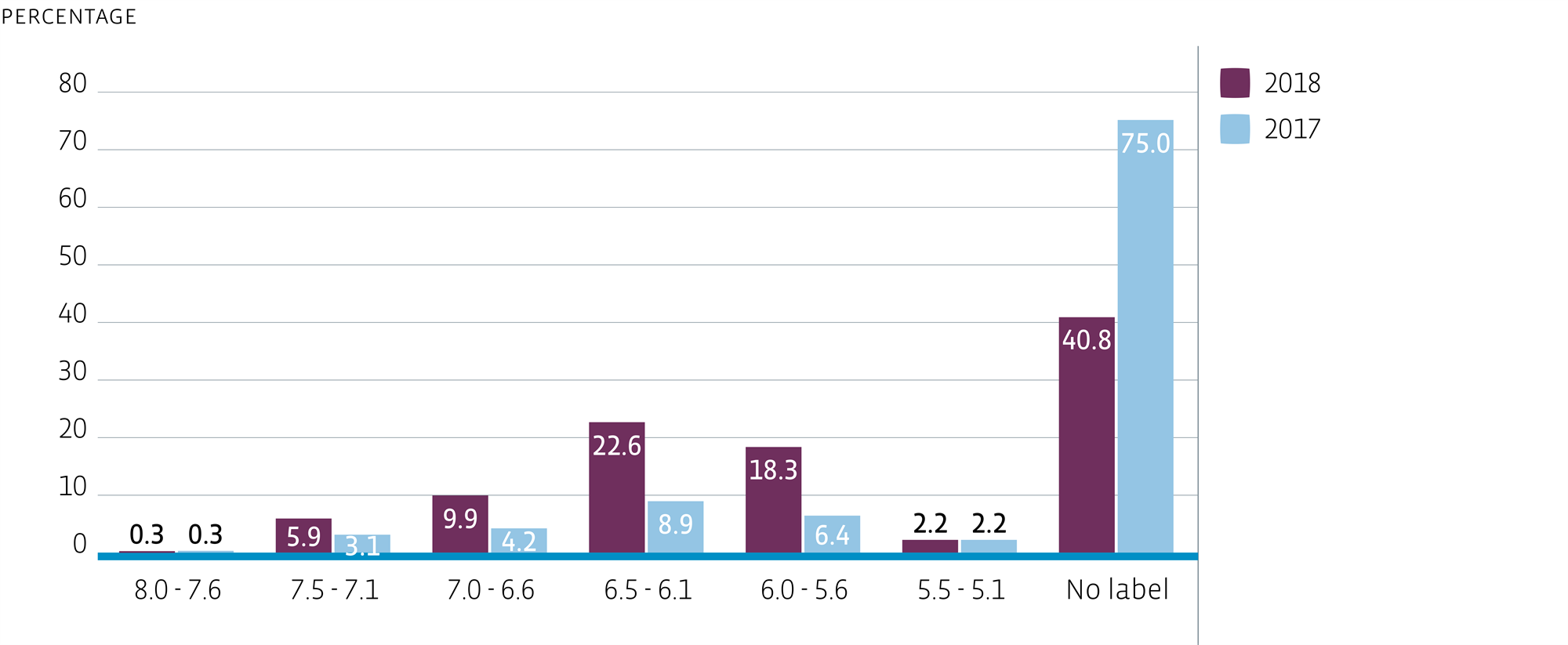

In 2018, 59.2% of the portfolio (% of m² lettable floorspace) received a GPR label with an average score of 6.3.

GPR scores (% of lettable floor space)

Targets on sustainable buildings & Investments |

100% GPR building labelled portfolio by end 2019 | On track: 59.2% of the homes (2017: 25%). |

Acquisitions and major renovations/ redevelopments minimum GPR building 7.5 | Achieved. |

Reduction of environmental impact

We are committed to making environmental stewardship an integral part of our daily operations and strive to reduce both our direct and indirect environmental footprint. Energy consumption accounts for a large proportion of a building’s environmental footprint. Data measurement and consistent reporting via certification schemes help us to increase our buildings’ energy efficiency and reduce the associated costs, in cooperation with our tenants. We have adopted maintenance strategies that include modern, energy-efficient heating, cooling and lighting systems.

Energy efficiency is the most cost effective way for the Fund to reduce carbon emissions but we also encourage the use of renewable energy sources. We buy certified green electricity and are boosting alternative energy use.

The Residential Fund’s sustainability strategy is focused on reducing the environmental impact of its properties while enhancing comfort, all in cooperation with our tenants and other stakeholders. For example, our standard programme of requirements for acquisitions and renovations focuses on structural quality, energy-efficient installations, water-saving fittings and maintenance-friendly and recycled materials. We have limited control in terms of influencing and measuring energy, water and waste reductions at tenant level, so we first focus on data collection of sustainability indicators in areas that we can control.

Sustainability improvements

By selecting and focusing on the top 50 largest energy consuming assets and installing LED lighting and relocation sensors, the Fund is on track to meet our environmental target.

On top of this, last year the Fund acquired a total of 410 homes that will have an energy index of zero upon completion. This will improve the average energy index of our total portfolio. This will put the Fund among the most sustainable residential funds in the Netherlands.

Monitoring performance

Monitoring environmental performance data (energy and water consumption, greenhouse gas emissions and waste) is an important part of managing sustainability issues. The Fund tracks and aims to improve the environmental performance of its managed real estate assets: those properties for which the Fund is responsible for purchasing and managing energy consumption. The Fund reports on energy consumption (electricity, heating and gas: the energy components) for apartment buildings, which translates to greenhouse gas emissions.

The Fund has set clear targets for the reduction of its environmental impact in the period 2018-2020:

Renewable energy: increase percentage of renewable energy

Energy: average annual reduction 2%

GHG emissions: average annual reduction 2%

Water: average annual reduction 2%

Waste: Increase recycling percentage

Renewable energy production

The Fund has steadily increased the generation of solar power, both for new properties and existing family homes. We have already achieved our goal for 2020 and we have included more ambitious goals in our Fund Plan for 2019-2021. From this moment on, we will fit all existing apartment buildings with solar power. We are also considering pilot projects for the storage of solar power in batteries. In 2018, we made 70 homes near carbon-neutral-ready by supplying air-source heat pumps to drastically reduce natural gas consumption.

Energy consumption and GHG emissions

In 2018, the Fund managed to cut electricity consumption by 1.8% (2017: 0.5%) and total energy consumption by 1.7% (2017: 1.7%), both on a like-for-like basis. The Fund purchases renewable electricity for common areas, while property managers are required to deliver sustainable alternatives for repairs and replacements based on the Total Cost of Ownership (TCO) principle.

Water consumption

The Fund’s standard programme of requirements includes water-saving fittings, and we are also investigating the potential use of water buffering and partly recycled (non-drinking) water, for instance for the maintenance of green areas. When we replace a bathroom, toilet or kitchen, we always include the installation of water-efficient sanitary. We take a strategic approach to water management because this enhances the efficiency, resilience and long-term value of our investments. The Fund is committed to reducing water consumption, maximising the reuse of water and preventing water pollution and flooding.

Waste

The Fund aims to manage waste at its properties responsibly. We encourage our tenants to minimise and recycle waste. We provide recycling bins and encourage the reuse of plastics, metal and other materials.

Green portfolio

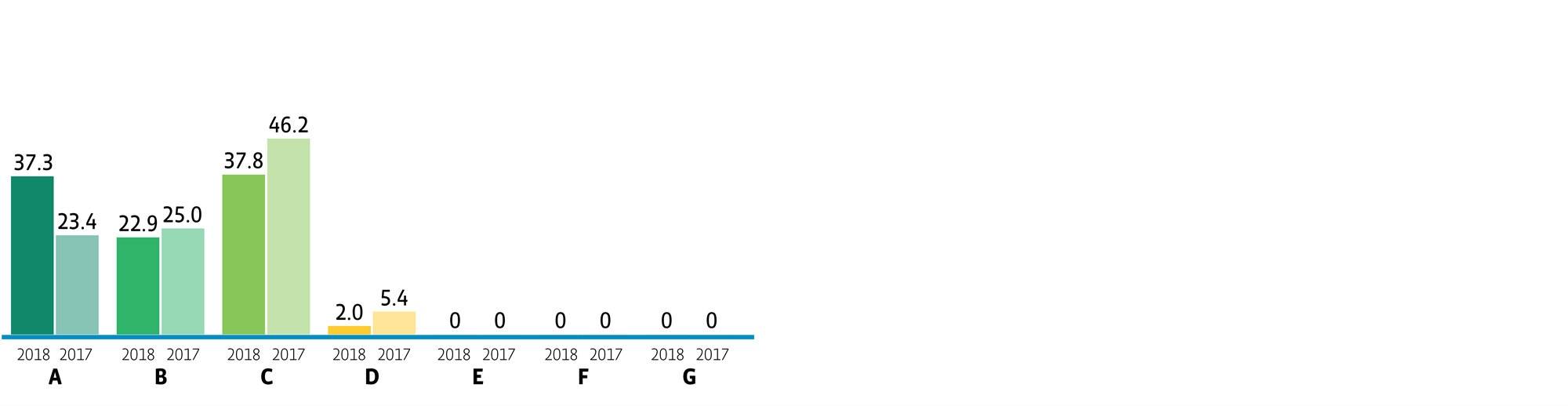

In line with the target we set for 2018 related to sustainability at asset level, the Fund now has a 100% green portfolio, as all assets have now received EPC labels A, B or C*. This followed measures to improve the sustainability of 170 homes with a D label, plus the disposal of a number of homes that did not qualify for green labels. The distribution of energy labels in the portfolio is shown below. Investment properties under construction are excluded from this overview. The Fund expects those properties to receive an energy label A upon delivery.

* Three assets with an EPC label D were sold in 2018 but will be delivered in the first quarter of 2019. Therefore, the graph still shows the existence of D labels in the portfolio.

Distribution of energy labels by unit (%)

Targets on reduction of environmental impact | |

Doubling energy generated on location in 2020 compared to 2016 (404 kWp) | Achieved: year-end 2018 c. 5,300 kWp. |

Reduce average annual environmental impact with 2% per year | Energy -1.7% |

GHG emissions -1.8% |

100% green portfolio (A, B, C energy labels) in 2018 | 98.0% |

100% (excluding buildings sold in 2018 but with deed delivered in 2019) |

10 zero on the meter projects by 2020 | Behind track. Three projects. |

The Fund redefined these targets in the Fund Plan 2019-2021 in such a way that we are now aiming to receive Energy label A for at least 65% of the portfolio (energy-index <1.2). We also raised the target for renewable energy generated by solar panels to 12,000 kWp by the end of 2021. The target for energy reduction is now 5% per year to put the target in line with (international) climate goals (reduction of 95% of CO2 in 2050 compared to 1990). The target for the zero-to-the-meter housing projects has been broadened to better match current developments: in the period 2019-2021, 70% of newly-signed acquisitions (€) will be near 'energy neutral' projects ('BENG'-proof).