The world in which Bouwinvest makes its long-term investments is marked by continuing urbanisation, ongoing globalisation, the increased ageing of the population, rapid technological changes and an urgent need to increase sustainability. Plus we are seeing the emergence of geo-political tensions. Are these trends a threat? Or are they in fact creating new opportunities?

Urbanisation

All over the world, people and businesses are moving to metropolitan regions. And that is not going to change any time soon. People and businesses are following each other in the search for work and good employees. The metropolitan regions are therefore growing faster than their countries as a whole. The challenge is to make sure these regions remain places where people can and want to live. Because the increasing pressure and densification is likely to increase air pollution and threaten green areas.

The continued pressure on urban environments is making homes more expensive: owner-occupier homes are becoming ever more expensive and there are simply not enough available and affordable rental homes to meet growing demand. Price rises have simply gone too far in some cities, making living in the city too expensive for a broad target group. This has led to falling prices in some cities. This situation offers institutional investors the opportunity to help reduce the shortage of homes and by doing so improve the inclusivity of the cities they invest in. At the same time, investors are facing the challenge of getting financially feasible projects off the ground in Dutch cities, due to rising ground prices and construction costs. This could slow down the realisation of sufficient new-build projects and lead to more projects with relatively small homes. These smaller homes may meet the current demand from the specific target group of one-person households, but this may not be the case in the longer term. We expect to see an increase in demand for homes in the municipalities around the big cities in the future.

Globalisation

Globalisation is marked by increasing economic, cultural and political integration at a global level. Thanks to digitalisation, it is easier for goods, services and people to move from one place to another. International online retail platforms like Alibaba and Amazon are spreading right across the world. More and more jobs are disappearing to low-wage countries and many of the jobs that remain are more flexible. In the ‘old world’, the uncertainty this is creating is leading to political tensions between low-skilled workers and the more highly educated and between young people and older people.

Economies that are transparent and societies with a high level of social equality are in the best position to profit from globalisation. But protectionism, the anti-globalisation movement, can have a negative impact on the real global economy. This could reduce the demand for real estate. On the other hand, increasing globalisation is boosting the growth of tourism and the continued internationalisation of the academic world. This could push up demand in all real estate sectors, but primarily for hotel rooms and student residences.

Technology

In the decades ahead, digitalisation, artificial intelligence and robotisation will all have a major impact on how we live, work, shop and move around. Smart buildings can help boost energy performance and improve the comfort of living and working environments. At the same time, technological developments such as big data, blockchain technology and increasing internet connectivity will have an impact on how we work. Employees will be more flexible and working at home will become even easier. This will affect the office market. ‘Online global access’ will increase global competition, both in the retail market (Amazon, Alibaba) and on the hotel market (Airbnb). This will have the biggest impact on the demand for physical stores.

However, rapidly changing technological developments are also creating opportunities for real estate investment asset managers, but they do need to be alert to opportunities and respond quickly. Globalisation and technology mean that real estate investment need to respond more quickly to global trends and developments. At the same time, we are faced with ever-increasing amounts of data, which real estate investment managers can use to track and respond to market developments.

Sustainability

There is growing global awareness that we urgently need to stop global warming and increasing CO2 emissions. The Paris climate agreement and the United Nations’ Sustainable Development Goals (SDGs) provide direction for what we need to do. And of course the built environment accounts for a large proportion of global CO2 emissions.

The demand for sustainable and circular buildings will increase worldwide, among both the users and the buyers of real estate. This is creating opportunities for a company like Bouwinvest, to invest in sustainable and energy-neutral real estate and improve the sustainability of its existing real estate. This could be through measures such as installing solar panels or investing in smart buildings. We also expect to see an increase in the use of public transport, which will make it attractive to invest in real estate developments close to public transport hubs.

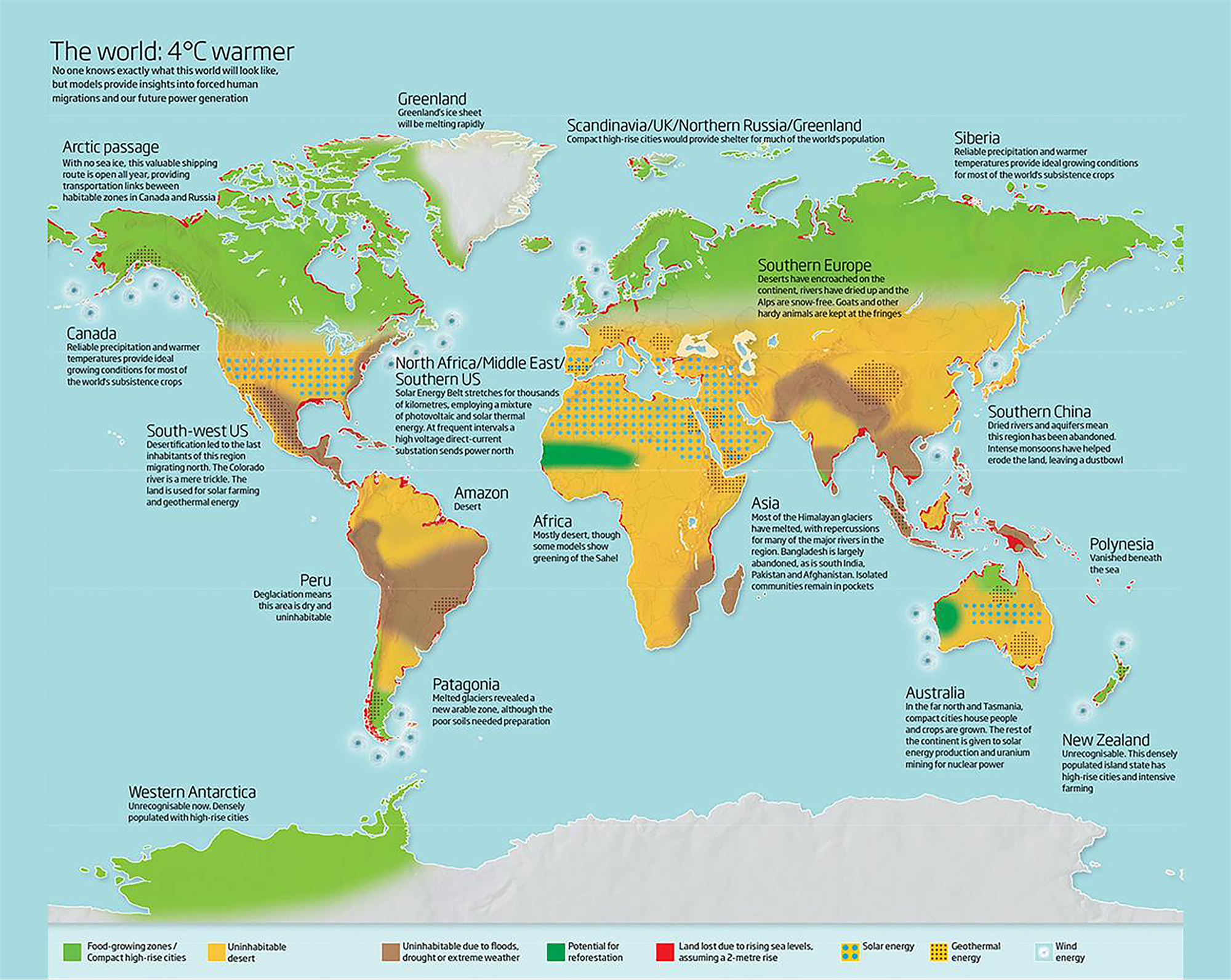

Global warming and rising sea levels will of course increase certain risks in the longer term, as certain places will eventually no longer be useable for homes, offices or other workplaces. This will increase migration to more habitable parts of the world. This will of course push demand to certain parts of the world, but could also lead to social unrest.

Climate change will lead to flooding in certain regions and drought in others. Many cities and metropolitan areas were not designed to deal with this kind of pressure. This will require investments in drainage and infrastructure to deal with floods and drought in the built environment.

Source: Parag Khanna, Connectography

Social-demographic developments

More wealth, better living conditions and good healthcare are increasing life expectancy. What is more, populations are not growing at the same rate everywhere. This will push up the average age of the population. In the Netherlands, for instance, by 2035 one in four inhabitants will be 65 or older and one in three of these will be 85 or older. This ageing population will put increasing pressure on collective amenities: higher healthcare costs and longer pension entitlements. The same ageing of the population will also result in a sharp increase in the demand for comfortable and safe rental homes. It will also require the expansion/improvement of current healthcare facilities. We are seeing the same trend at an international level, with steadily increasing demand for healthcare accommodation.

But ageing is not the only social-demographic development. We also have the strong growth of the middle class in Asia, which is having a positive impact on consumer spending and international tourism. The average household size is declining worldwide, which is changing the demand for real estate. At the same time, the pay gap is growing in Europe and the United States, which is reducing the size of the middle class in both regions.

Geopolitical developments

Nationalism and populism are on the rise in an increasing number of countries on the international politics and trade relations fronts. International migration is also putting increasing pressure on individual countries and on international treaties. Brexit, the divisions in the European Union, the outspoken presidency of Donald Trump and the trade war between the United States and China are all examples of the rise in populaism and nationalism . These geopolitical developments are creating uncertainty and could have an impact on capital markets, the real economy and – indirectly - on real estate in the period ahead.

A long-term real estate investor constantly has to deal with these kinds of global developments. The recent geopolitical tensions underline the importance of a global investment strategy. A good geographical spread of investments can reduce the sensitivity to conflicts and disasters.