Overview of Fund plans

| | Plan 2018 | Result 2018 | Result 2017 |

Income return | 2.3% | 2.3% | 2.9% |

Capital growth | 4.0% | 9.2% | 10.2% |

Total Fund return | 6.3% | 11.5% | 13.1% |

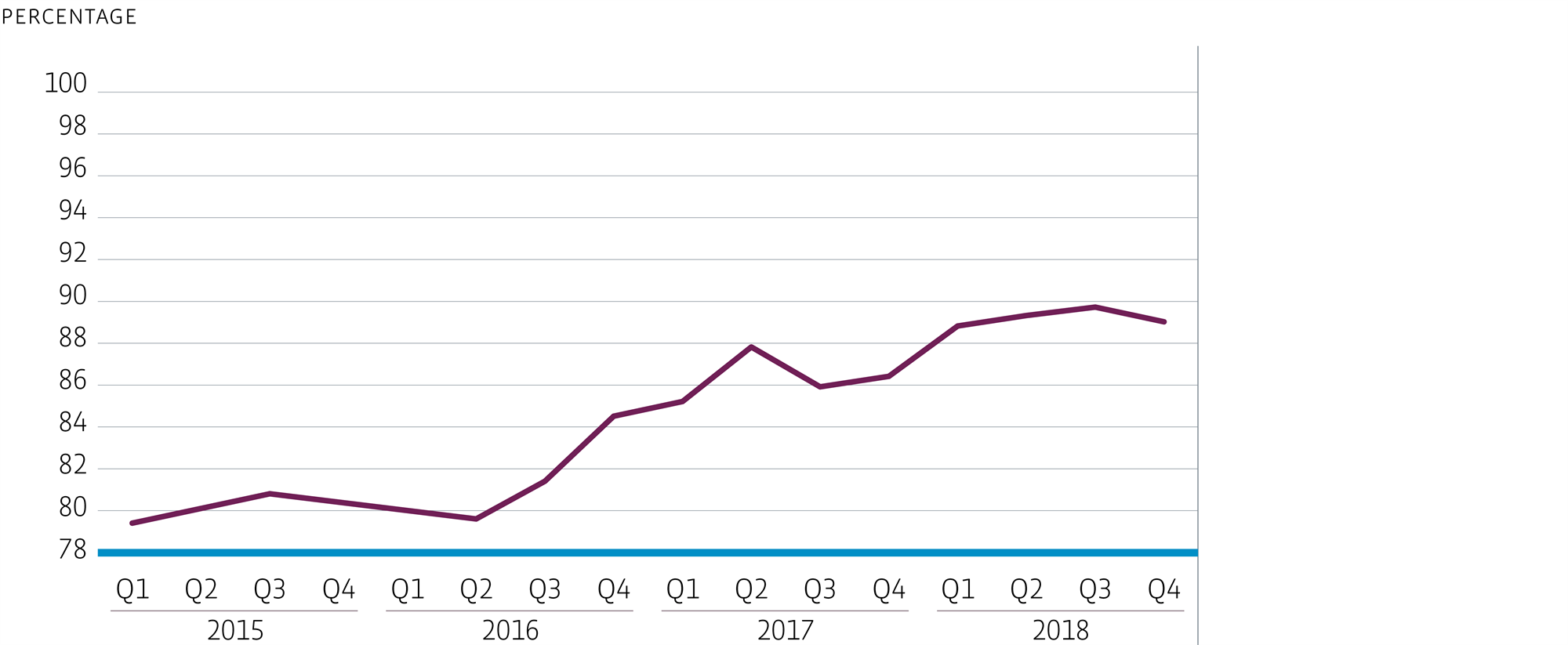

Occupancy rate | 86.5% | 89.2% | 86.3% |

Investment | € 144 million | € 90 million | € 35 million |

Divestment | € 100 million | € 0 million | € 0 million |

Funding | € 0 million | € 0 million* | € 145 million |

* per 1/1/2019 new funding is acquired for € 223 million

Investments, divestments and redevelopments

The Fund made one acquisition in 2018 and invested in the redevelopment and optimisation of the quality of the Fund's assets. The size of the Fund's total portfolio increased to € 747 million in 2018 from € 596 million at year-end 2017. This growth was largely driven by investments in Hourglass, the redevelopments of Building 1931 and Building 1962 (all in Amsterdam), the acquisition of Central Park in Utrecht and by positive revaluations, driven by improved circumstances in the investment and occupier markets on the back of strong economic developments. All of these developments led to a further optimisation of the Fund’s portfolio, both in terms of geographical spread, asset enhancements and occupancy rate.

Investments

The plan for investments in 2018 was € 144 million. The investment plan consisted of cash out for development expenses for assets in the pipeline, which were acquired as turn-key assets from real estate developers, redevelopment expenses for assets that are being redeveloped through Office Development and property upgrades for several existing assets in the portfolio. Lower investments in 2018 (€ 90 million) compared to the plan are mainly a result of a late transfer deed for Central Park (Utrecht) and postponed execution of property upgrades for the Olympic Stadium Amsterdam and WTC Rotterdam.

Central Park, Utrecht

The Fund acquired the new-build office building Central Park in October 2018. This 22-storey building will offer approximately 28,000 m2 of office space and 500 m2 for catering facilities, as well as parking for 370 cars. Central Park is located in the new Central Business District of Utrecht next to the city’s Central Station and town hall. The name Central Park stems from the plan to include a two-floor park-like environment in the centre of the building for the communal use of the building’s office tenants.

The Fund initiated full-scale leasing activities for Central Park in 2018 and this will continue into 2019. The Fund will cooperate with the seller/developer on this front, as they are in the lead. This is due to the fact that the definitive purchase price will very much depend on the results of the leasing activities. Given the current market conditions in Utrecht (vacancy is 1-3% in the area around the central station), the location and the sustainable nature of the building’s design, the leasing outlook is positive. The delivery of this building is scheduled for Q2 2021.

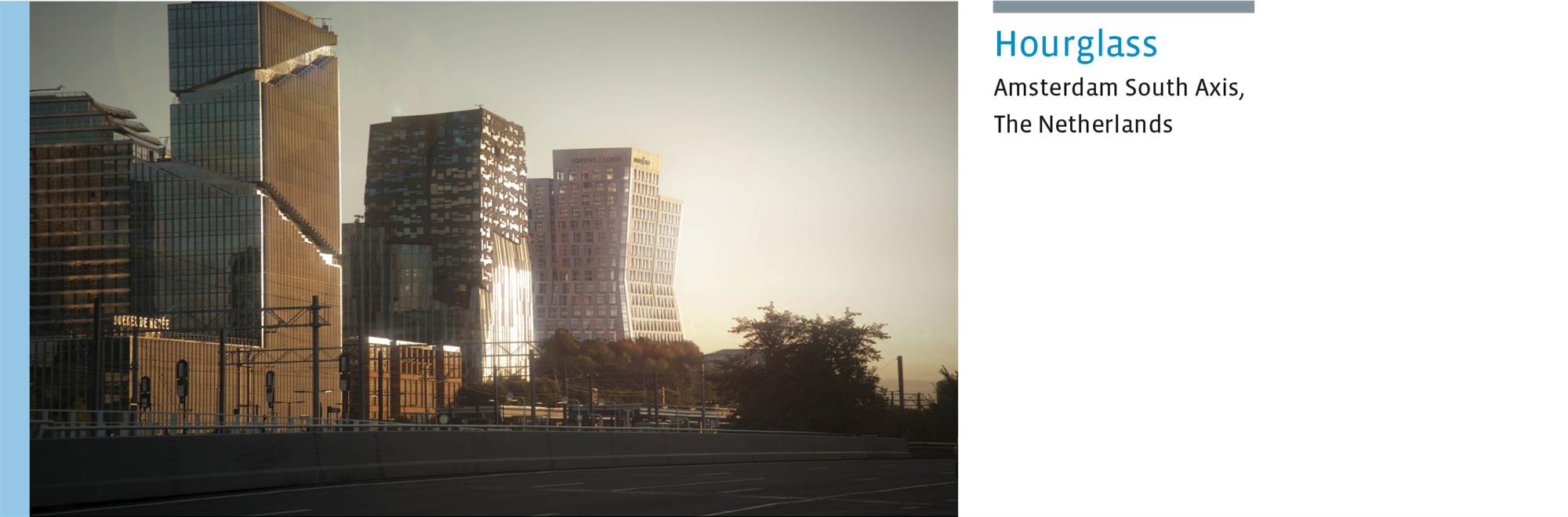

Hourglass, Amsterdam

Hourglass is largely pre-let to Dutch law firm Loyens & Loeff. They have leased around 15,500 m2 of the total 21,949 m2 of office space. Loyens & Loeff could still decide to lease all other available space. It is therefore possible that this will become a single-tenant asset. Should Loyens & Loeff decide against expansion, it is deemed extremely likely that the office space in this building will be leased to other tenants before completion. Delivery of this asset is still foreseen for Q4 2019.

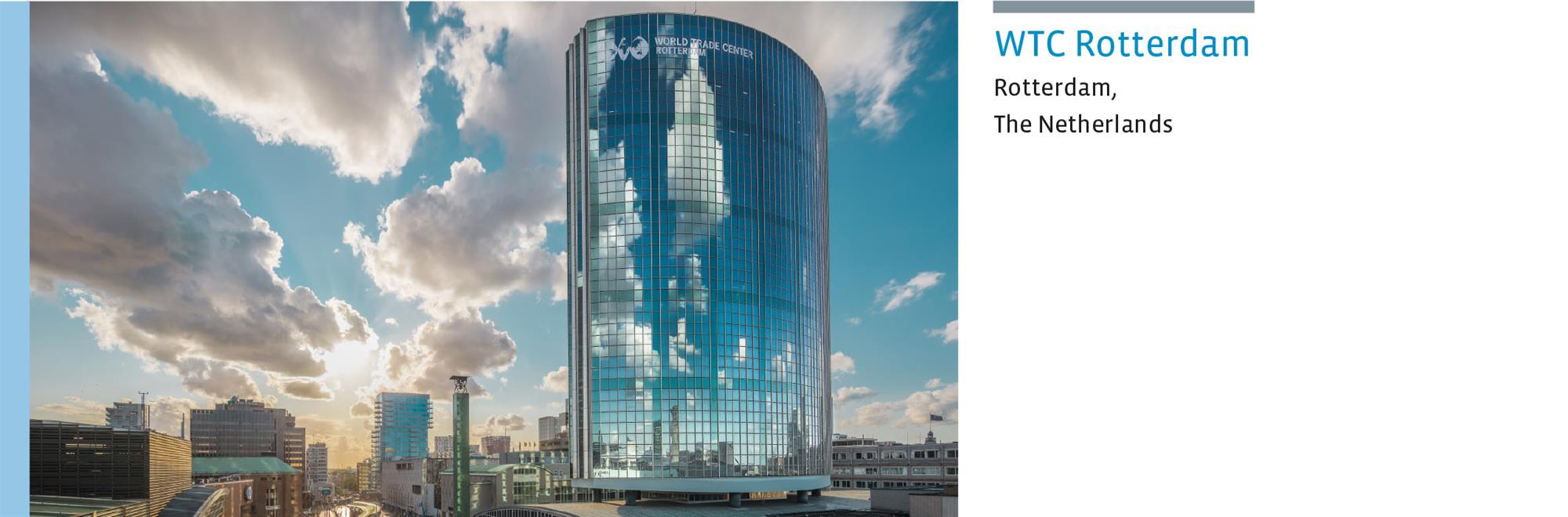

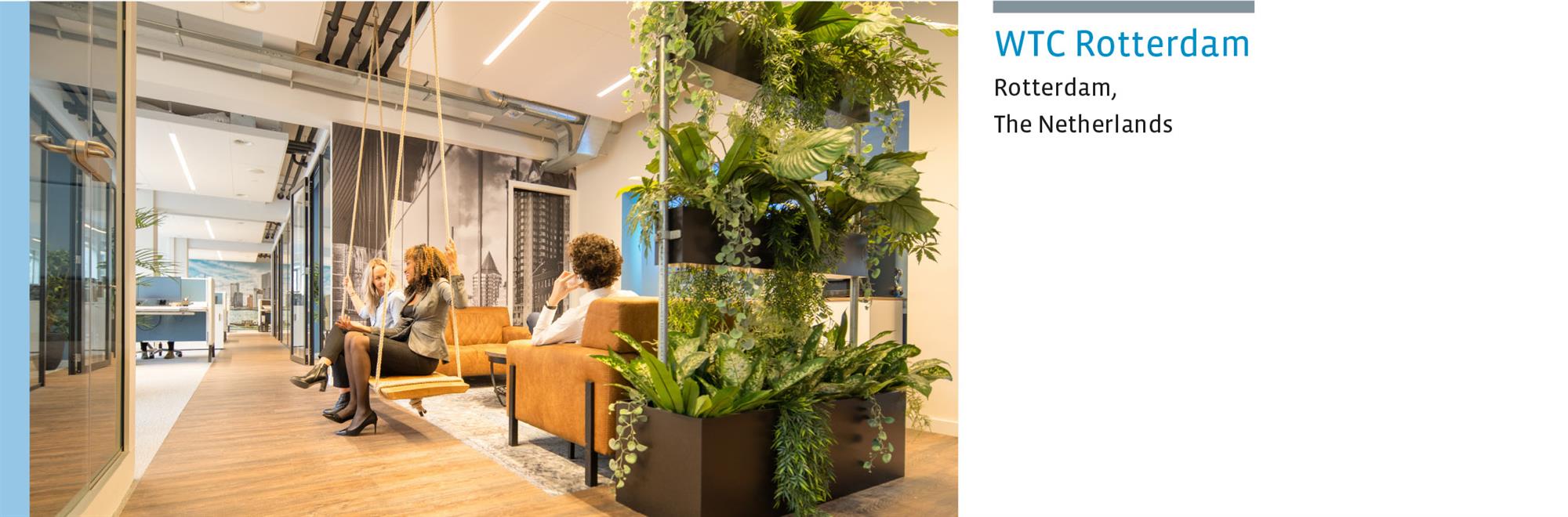

WTC Rotterdam

The WTC Rotterdam building has been enhanced on a number of fronts. These include the completion of the renovation of additional high rise office floors, the preparations for a future fitness training space and a project to upgrade the central entrance area. The latter capital expenditure consists of a change in lay-out for service desks and the upgrading of the lobby area, including a stylish coffee corner and the relocation of flexible working spaces from the third floor in the low-rise section to an accessible and inviting location adjacent to the main entrance of the building. The coffee shop – de Koffiesalon – opened in September in the partially renovated entrance hall, immediately next to the main entrance adjacent to the new Business Center, which opened its business rooms and flexible working spaces in late 2018.

Following the Dutch Cultural Heritage Agency’s approval of the master plan for the listed section of the building, with more than 20 investment projects, the Fund will apply for building permits for each sub-project. This should in principle result in faster decision-making by the Rotterdam city council than the 26 weeks that can be applied legally due to the listed status of the building.

Over the next three years, the occupancy rate is expected to increase from 57% in 2019 to 71% in 2020 and 91% in 2021. The presumed leasing of the hotel section to a hotel operator will make a significant contribution to the increased occupancy in 2020. Although the recovery in the Rotterdam users market has so far lagged the recovery seen in the other three major office markets, the outlook is positive. High-quality office space is scarce, while rent levels are extremely affordable in relative terms. The planned investments, combined with the right marketing campaigns, will help create opportunities for new leases and increased occupancy.

Olympic Stadium, Amsterdam

The most important upgrade projects for Olympic Stadium are the building of a climate installation for each unit and the replacement of the inner façade of the asset. This will both improve the comfort and energy efficiency for tenants. The execution of this project is running parallel to a relocation plan for several units. The relocation of Under Armour to Building 1962 is one important element in this. Due to the delay of completion of their new offices, the façade project for the Olympic Stadium was also delayed. A number of units have already been leased to new tenants and this will enable the Fund to carry out a far-reaching reorganisation of the offices. A new planning for completion of the façade project also depends on further technical studies into the concrete damage that was detected during the replacement of the first façade sections.

Redevelopments

Building 1931 and Building 1962, Amsterdam

In July of last year, Bouwinvest Office Development assumed control of the redevelopment of the two former Citroën buildings (Building 1931 and Building 1962) on the Stadionplein in Amsterdam. The Fund appointed a task force and drew up a new and realistic planning. Building 1962 was delivered in January 2019 and Building 1931 will be delivered in August 2019. Building 1962 is fully leased to Pon Holdings, which will use the building for its head office and as a showcase for its future mobility experience, under the name Move. The Fund devoted a great deal of time and effort to leasing activities for Building 1962 in 2018 and this will be leased to multiple tenants upon completion.

The permanent improvement of the entire area, which has been branded The Olympic Amsterdam, requires close cooperation between numerous stakeholders. The Fund took the initiative to meet with parties including real estate owners, users and the Amsterdam city council. This led to discussions on topics such as the lay-out and design of public spaces, the re-opening and branding of the assets and the site and the organisational structure of the area management. This resulted in the installation of a foundation to take charge of area management and a conceptual investment plan and budget in 2018.

Divestments

The plan for divestments of € 100 million was cancelled in the course of 2018. A divestment process was terminated, because holding the assets would no longer affect the risk profile of the Fund as much as it did in 2017, when the plan was set. The Fund made no divestments in the year under review.

Active asset management

Strong economic developments and various active asset management activities resulted in a large number of new and renewed leases, especially in Amsterdam and The Hague. The average occupancy rate in the Fund’s portfolio in 2018 was 89.2% compared to 86.3% a year earlier. This will improve further upon the completion of the Funds new-build assets and the redevelopment and renovation of its other assets. Please find below brief explanations of the activities at a number of important assets from the portfolio.

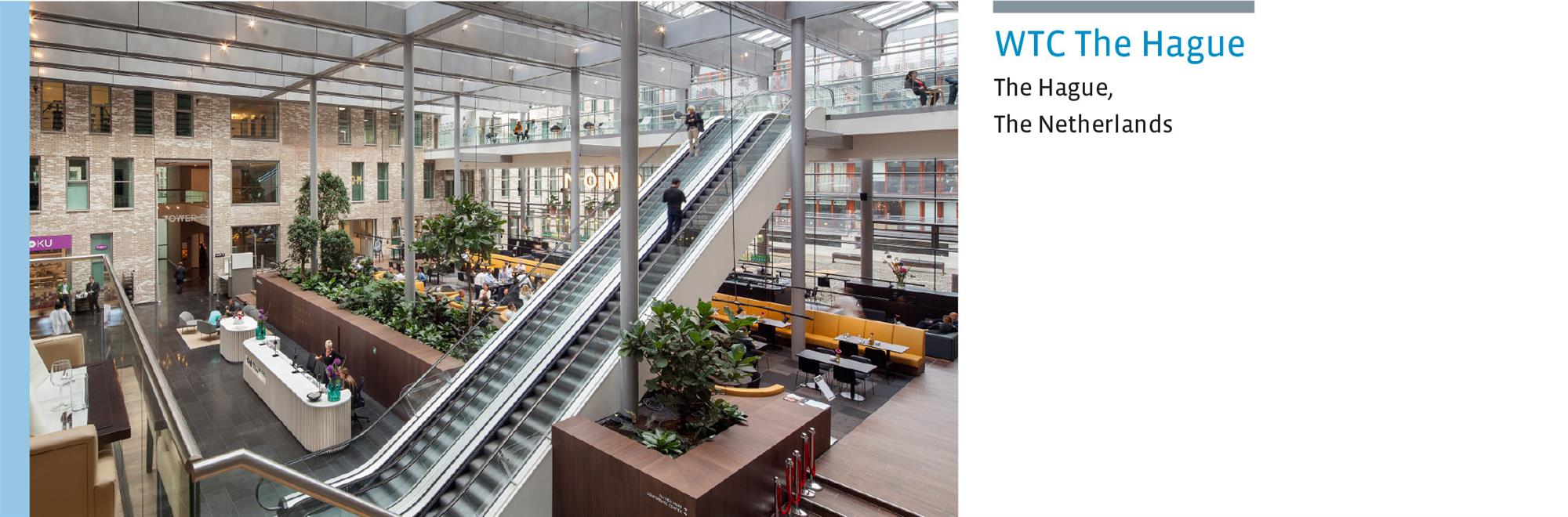

WTC The Hague

Following the completion of the single reception area in WTC The Hague, which now combines a whole range of services and facilities, leasing activity has picked up enormously. The upgrade boosted the dynamics in the building, creating a vibrant space that has inspired companies to hold their meetings and events in WTC The Hague. It has also been a major factor in the strong uptick in new lettings and lease renewals. And now that the user market in The Hague has improved, WTC The Hague is on the short list of most potential tenants. The occupancy rate for this building increased to 91.8% in 2018, compared with 82.5% in 2017.

Centre Court, The Hague

The extention of the lease with the Government Real Estate Agency for approximately 30,000 m2 was the Fund's most substantial lease renewal and contributed significantly to both an increase of secured rent and the weighted average remaining lease term at portfolio level. In anticipation of the announced departure of publishing firm SDU Uitgevers, the Fund has organised viewings for several potential new tenants. The outlook for new leases is positive, as the supply of available office space is falling steadily in The Hague in general and the high-grade Beatrixkwartier in particular, while the demand is only increasing. SDU Uitgevers was one of the first tenants in this building. They moved into their current space immediately after the building was delivered in 2002. This means we will have to renovate before we can lease this space.

In addition to attracting new tenants, we are also devoting a great deal of time and attention to increasing the satisfaction of existing tenants. Tenants and users acting as ambassadors for a building provide the best references and are in the best position to convince potential new tenants. This means it is vital that users feel as if they belong to a community in a building. In 2018, we started supporting this via a mobile app, which we will develop into a service platform that includes functionalities for user-friendly access to various services and facilities, such as reserving and paying for meetings rooms, a parking space or a spot of lunch.

New technologies and innovations are emerging at a breakneck pace, many paving the way to a more sustainable future, but also creating a new dilemma. What new technologies will prove successful in the long run, or which start-ups will evolve successfully into fully-fledged businesses? Because many start-ups disappear almost as quickly as they appear announcing their arrival as the next big thing. What is certain right now is that new technologies and innovative products will pave the way to greater sustainability. The question remains, which ones?

With this in mind, Bouwinvest keeps a very close eye on innovative trends and developments, and is constantly on the look-out for innovations that can help us achieve the Fund’s main (sustainability) goals. And for new partnerships with innovative start-ups that we believe will help us to achieve our long-term sustainability goals. Following pilots in 2017, we added several new services and projects in which we see added value for our tenants and other stakeholders, some of which are described elsewhere in this annual report.

Portfolio diversification

Portfolio composition at year-end 2018:

Total portfolio of € 747 million (18 properties, 264,370 m²)

Two office redevelopment projects (two properties, 20,034 m²)

Two office development projects (two properties, approx. 50,422 m2)

Type of property

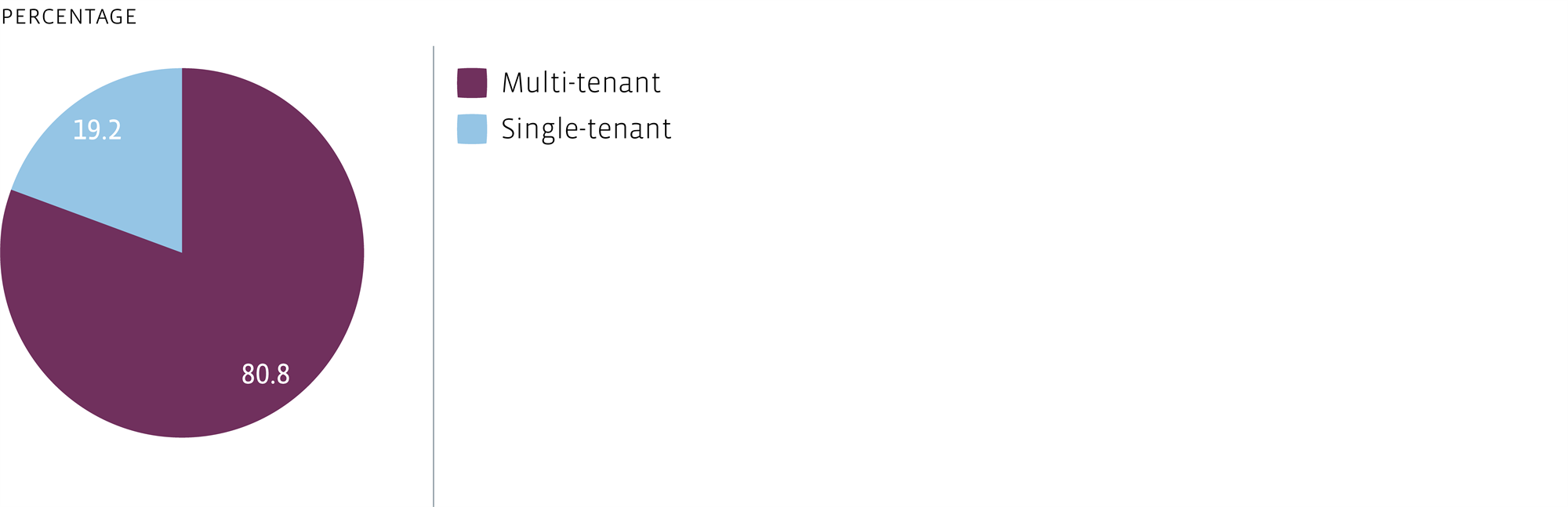

Multiple lease agreements reduce the volatility of revaluations and help increase the control of asset management risks. Furthermore, the Fund focuses on locations that attract a widely diverse group of people and offer a mix of culture, education, sport and work facilities.

The share of multi-tenant assets in the portfolio declined to 80.0% in 2018 (2017: 95.1%), due in part to the reclassification of Centre Court as a single-tenant asset as of 1 January 2018. This is still in line with the diversification guideline of > 70% multi-tenant assets of the total portfolio. The composition will change in 2019, following the addition of Building 1931 (single tenant) and Building 1962 (multi-tenant). Hourglass in Amsterdam may also become a single-tenant asset, if Dutch law firm Loyens & Loeff decides to take up the remaining available space.

Allocation of investment property by single vs. multi-tenant based on market value

Core regions

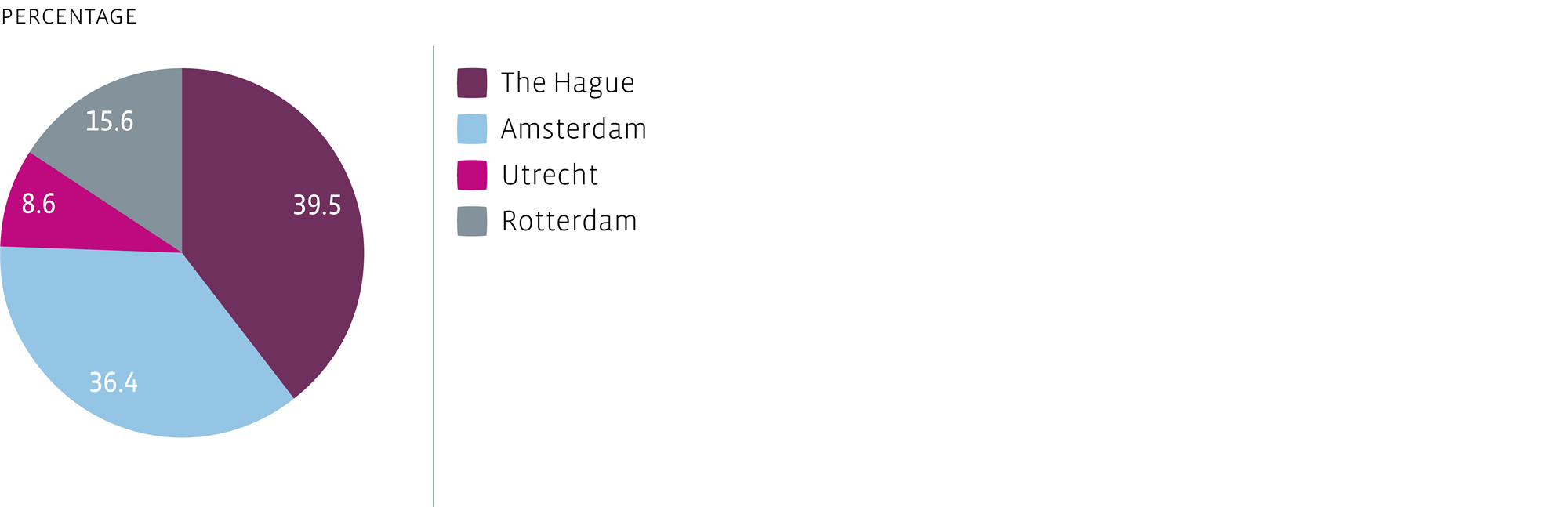

At year-end 2018, 100% of the Fund's assets were located in the four core regions: Amsterdam, Rotterdam, The Hague and Utrecht.

Both the Hourglass project in Amsterdam, once completed, and the redevelopment of Building 1931 and Building 1962 in Amsterdam will improve the Fund’s portfolio diversification, reducing the share of the portfolio accounted for by The Hague in particular, and increasing the proportion of assets in the Dutch capital. Once Central Park is completed in 2021, the Fund’s portfolio will be close to the targeted composition of 40% in Amsterdam and 20% in Rotterdam, The Hague and Utrecht.

Allocation of investment property by core region based on market value

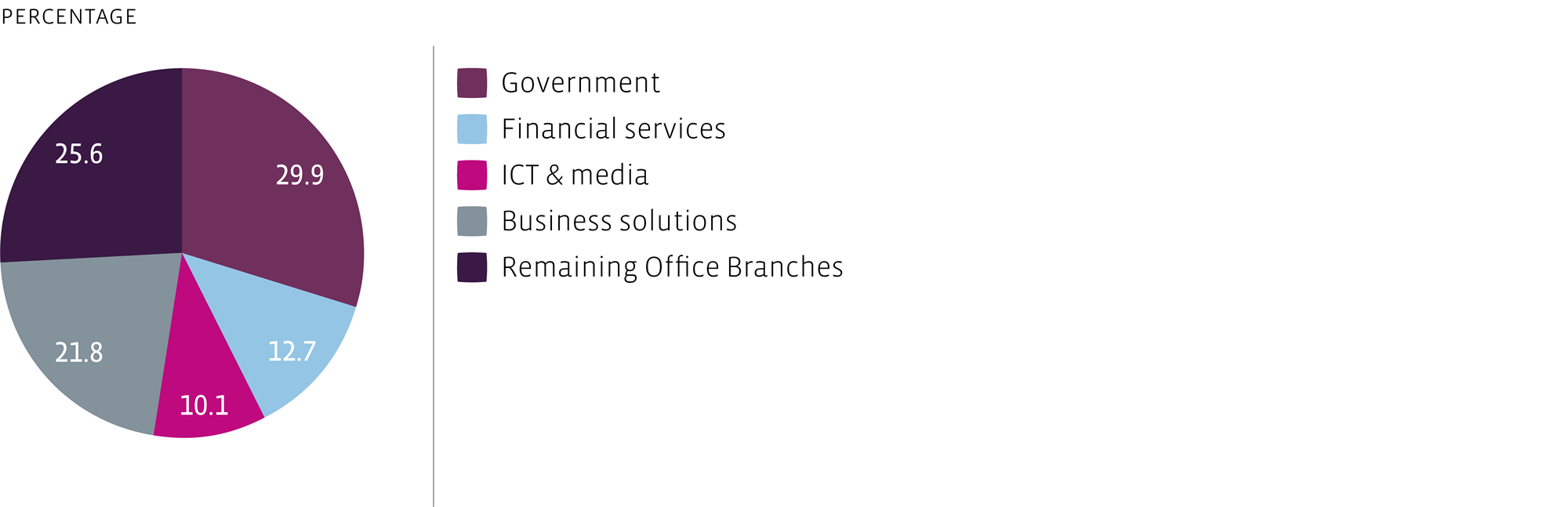

Tenant mix

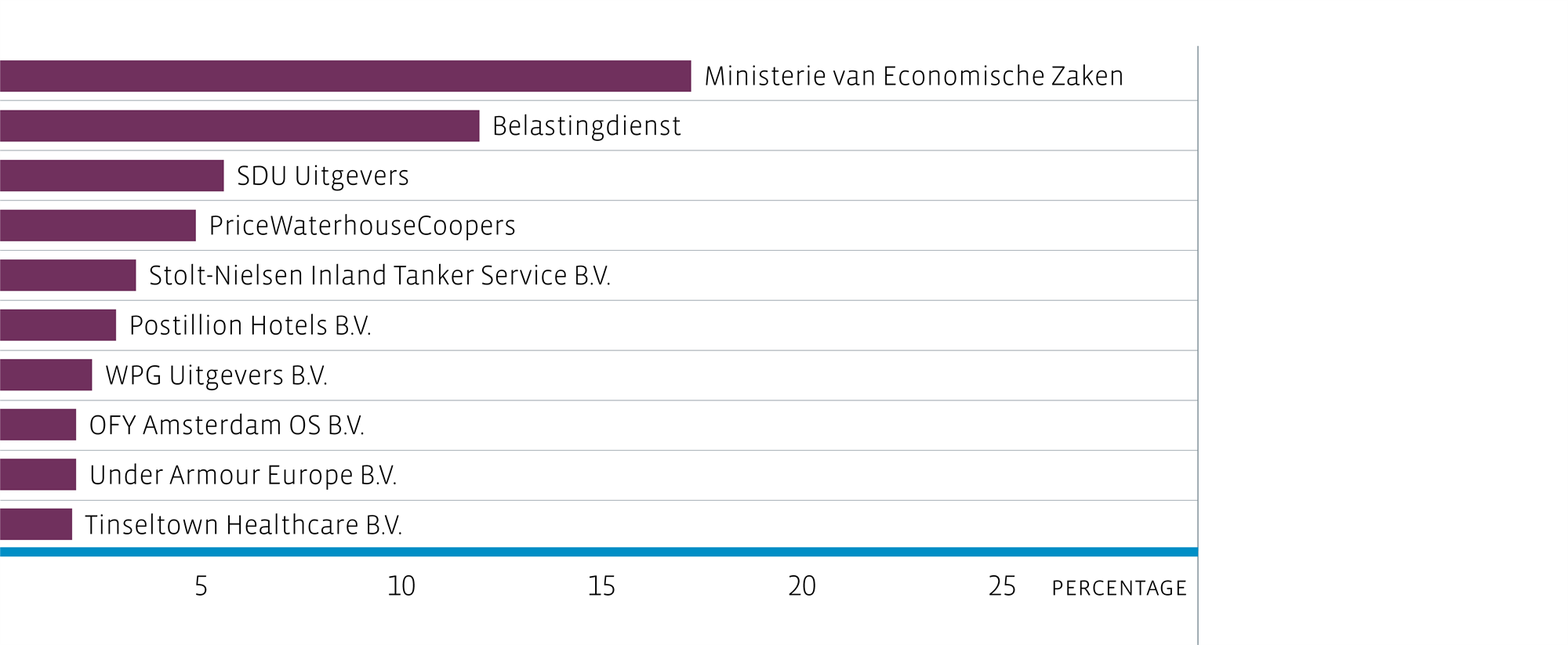

Most of the Fund's tenants are considered to have a low debtor's risk. The top five tenants accounted for a total of 43.2% of the passing rent in 2018 (2017: 49.7%), which is in line with the Fund's diversification guideline that the total rental income of the five largest tenants may provide a maximum of 50% of the total potential rental income of the Fund.

The Fund negotiated leases with a number of new and existing tenants in 2018, closing leases for 68,305 m² of office space and annual rent of € 14.4 million. We maintain close relationships with all our tenants to ensure we can respond promptly to their evolving office requirements.

Allocation of investment property by tenant sector as a percentage of rental income

Top 10 major tenants based on theoretical rent

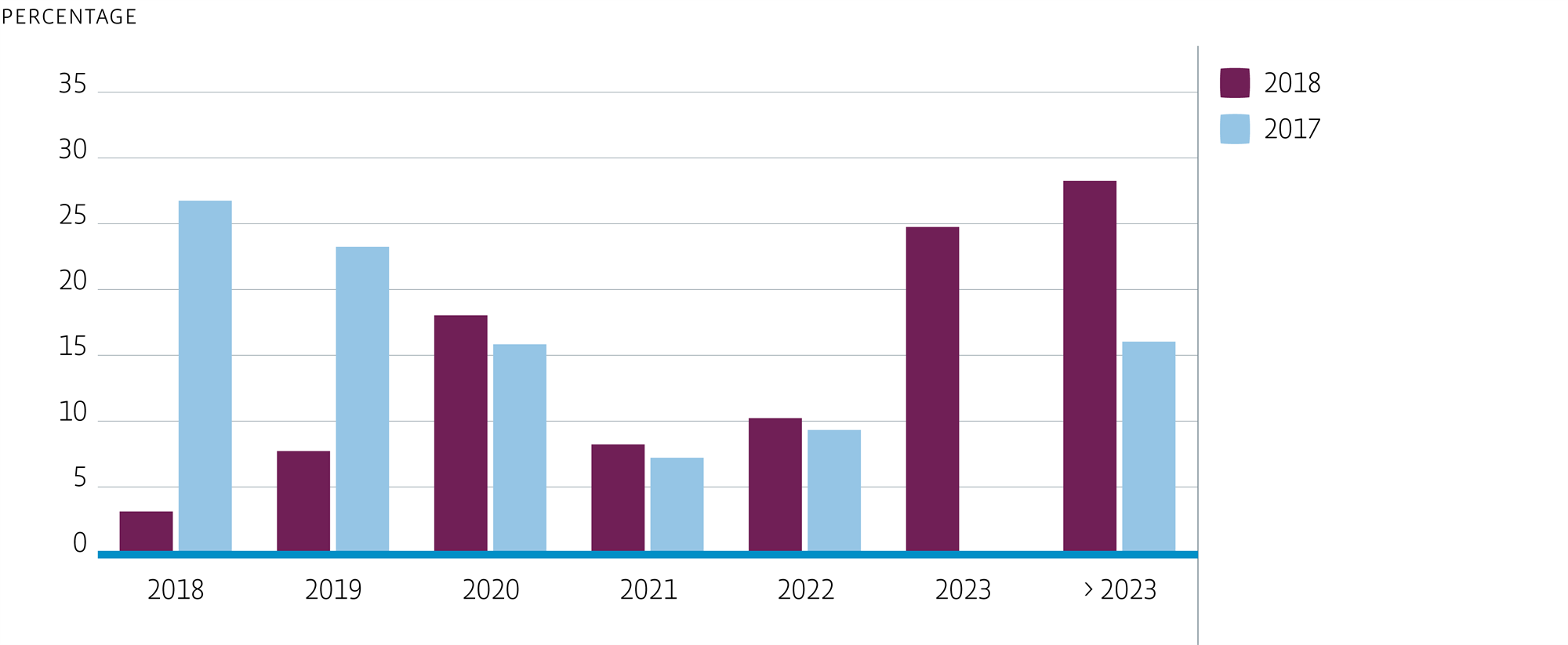

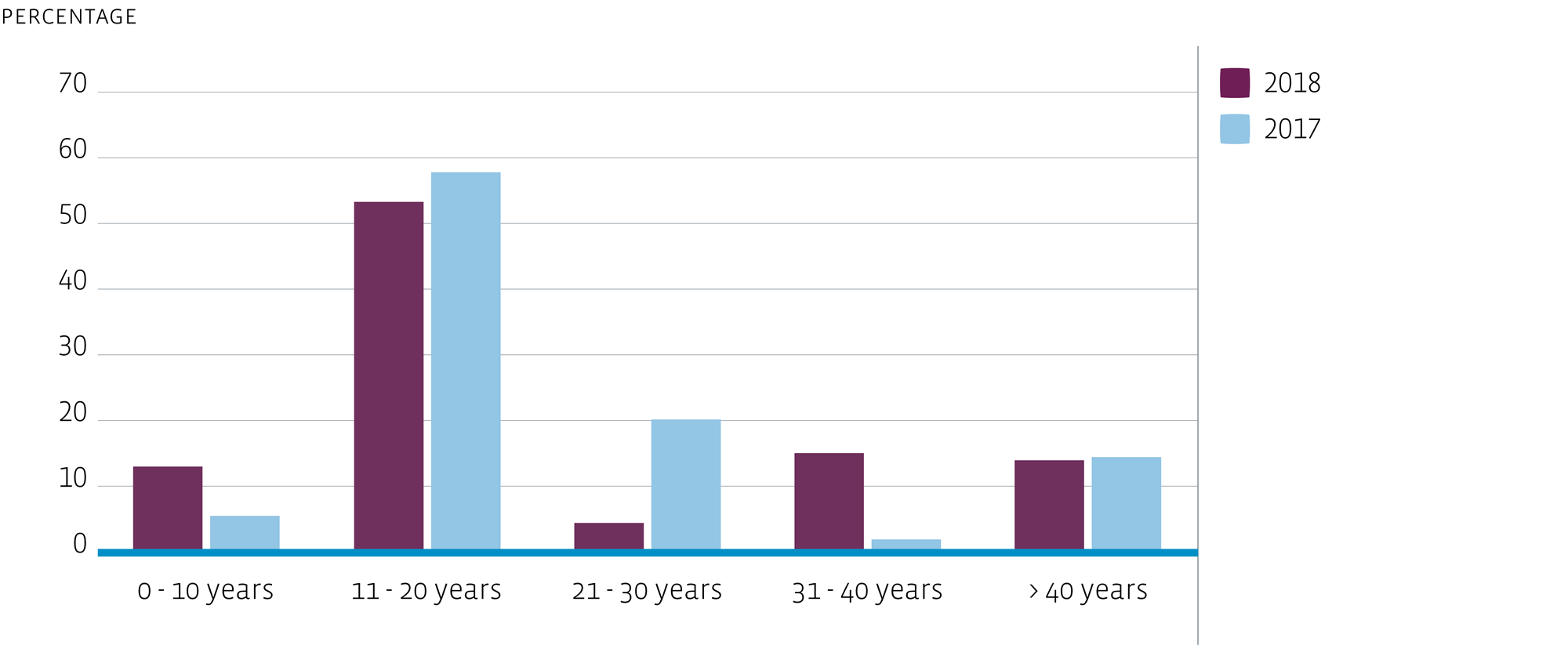

Expiry dates

Close relationships with tenants enable the Fund to propose lease extensions at the right time. However, lease endings are taken into account and the Fund anticipates this to attract new tenants. As per 31 December 2018, the weighted average remaining lease term of the Fund stood at 4.1 years.

Expiry dates as a percentage of rental income

Age

More important than age is the asset's distinctive character, its location and return prognosis. Some assets have a listed status based on their rich history and architecture. The age of these assets increases the average age of the portfolio. However, the new-build, mixed-use Hourglass building in Amsterdam will reduce the average age of the portfolio from 2019 onwards, while the new-build Central Park project in Utrecht will reduce the average age of the portfolio even further from 2021 onwards.

Allocation of investment property by age based on market value

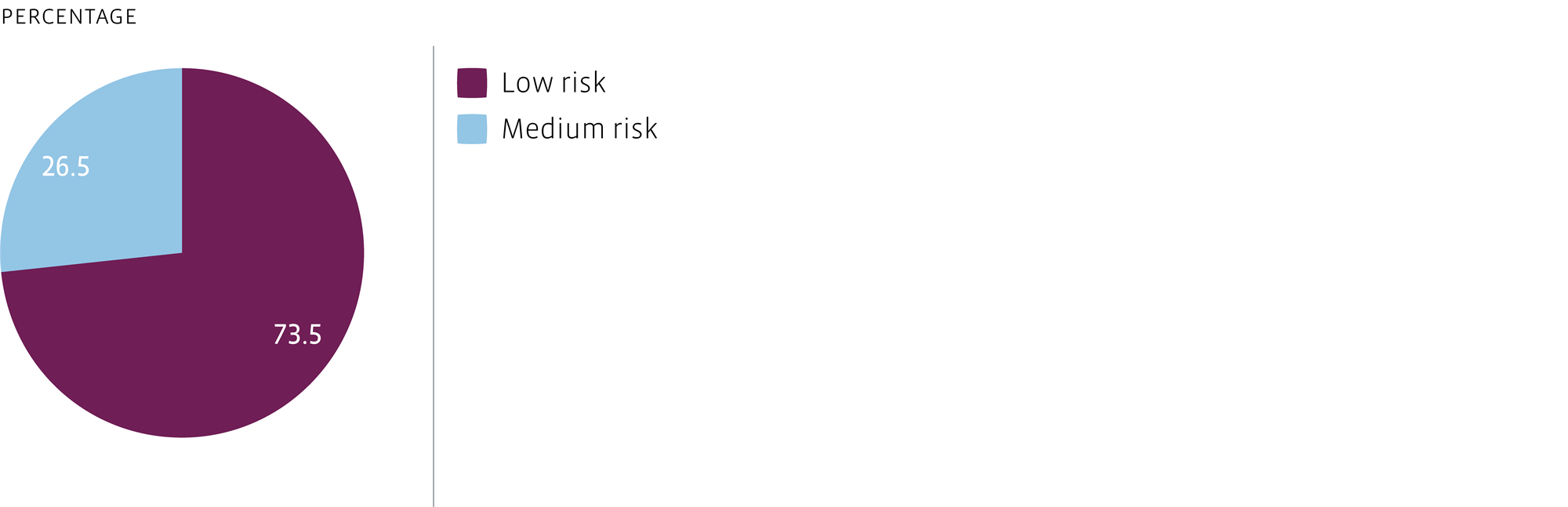

Allocation by risk

In terms of risk diversification, at least 90% of the investments must be low or medium risk. The actual risk allocation at year-end 2018 is shown in the figure below. Every year, we assess all properties separately. In 2018, the Fund was classified as 100% low to medium risk and as such was consistent with the framework of the Fund conditions.

Future investments related to WTC Rotterdam, Building 1931, Building 1962, Hourglass in Amsterdam and Central park in Utrecht will lower the risk profile of the Fund even further once they are added to the portfolio.

Allocation of investment property by risk category based on market value

Financial occupancy

In 2018, the occupancy rate increased to 89.2% from 86.3% at portfolio level. New lettings for WTC The Hague made a particularly strong contribution to this increase.

The Fund is devoting a great deal of time and energy to online lead generation. Potential tenants are increasingly turning to the internet as their (first) search engine for office space. On the basis of a number of customer journeys we mapped out for various target groups in 2017, last year we invested in the optimisation of the online presence of our buildings and the targeting of virtual visitors via the continued development of websites using Search Engine Optimisation (SEO), Marketing Automation and a CRM system.

Financial occupancy rate