Overview of Fund plans

| | Plan 2018 | Result 2018 | Result 2017 |

Income return | 4.4% | 3.6% | 4.5% |

Capital growth | 3.2% | 2.0% | 3.3% |

Total Fund return | 7.7% | 5.6% | 7.8% |

Occupancy rate | 96.5% | 95.2% | 95.6% |

Investment | € 80 million | € 66 million | € 77 million |

Divestment | € 30 million | € 2 million | € 0.6 million |

Funding | € 60 million | € 62 million | € 55 million |

Investments, divestments and redevelopments

In 2018, the Fund made two acquisitions, sold two assets and added one new asset to the portfolio. Furthermore, the Fund invested in two redevelopments and in the optimisation of the quality of its assets. These investments helped take the total value of the portfolio to € 958 million at year-end 2018 from € 877 million at year-end 2017.

Investments

The Fund invested a total of € 66 million, which was € 14 million lower than our original plan. These investments helped take the total value of the portfolio to € 958 million at the end of 2018. Of the total acquisitions, € 17 million was in line with our Experience strategy, while € 47 million was invested in line with our Convenience strategy.

Acquisitions

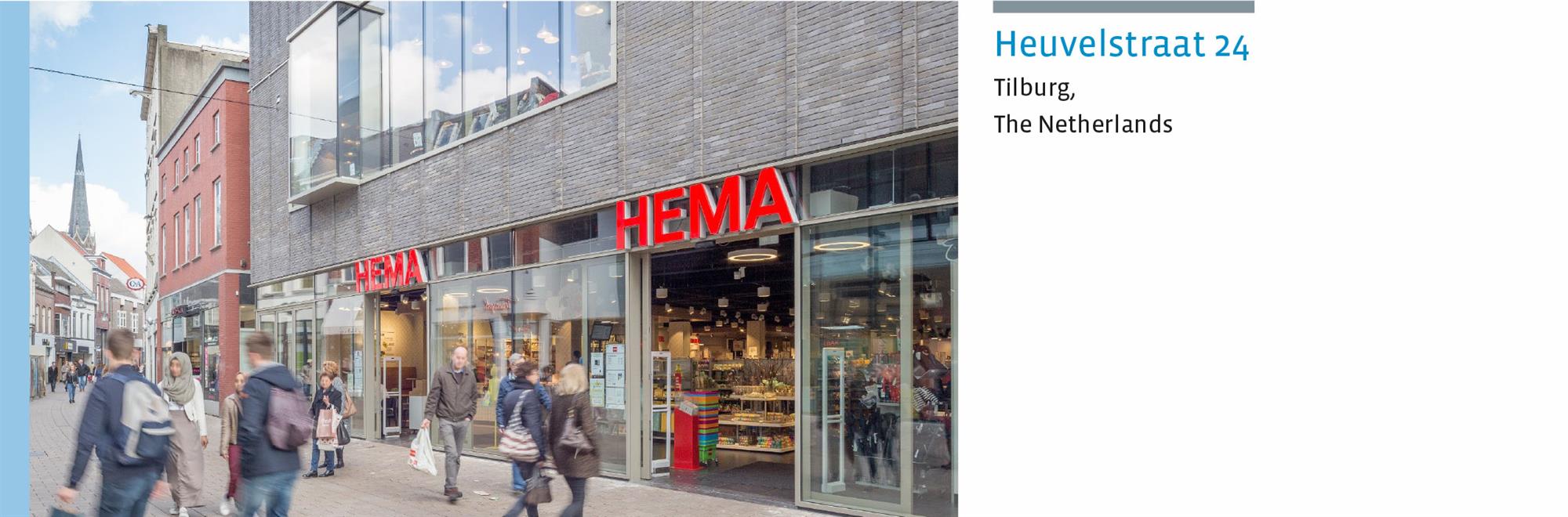

Heuvelstraat 24 and 36-38, Tilburg

In November, the Fund acquired two high street retail assets on the busiest shopping street in the centre of Tilburg. Tilburg is ranked 15 in Bouwinvest’s top 20 shopping cities. Heuvelstraat 24 is rented to retailer HEMA. This unit has ground floor of 1,210 m2, a first floor of 1,209 m2 and an 817 m2 storage cellar. The HEMA store was recently converted to the chain’s latest 'HEMA Worlds' concept and has a restaurant on the first floor of the building. Heuvelstraat 36-38 is rented to shoe store Manfield. This unit has a ground floor of 182 m2, a 62 m2 cellar and a first floor with five separate student rooms. Both retail units are an excellent fit with Bouwinvest’s Experience strategy.

Portfolio of 13 supermarkets, including 11 Jumbo stores

In December, the Fund acquired a portfolio of 13 supermarkets across the provinces of Overijssel, Noord-Brabant, Zeeland and Zuid-Holland. In total, 11 supermarkets will be transformed into the new Jumbo formula with a strong emphasis on (fresh) experience and food service. Retailer Jumbo has grown over the past decades from a regional supermarket chain to an active market leader. With a turnover of more than € 7 billion and a market share of 20%, Jumbo dominates the market for daily groceries together with retailer Albert Heijn. The purchase represents a major addition to the Fund's Convenience strategy and ensures a stable rental income with new 10 and 15-year leases. The largest supermarket is 2,084 m2, while the smallest store is 895 m2.

New assets added to the portfolio

Centrumplan shopping centre, Rosmalen

The Centrumplan shopping centre in Rosmalen includes 19 retail units with a combined size of 6,448 m2. The total annual rental income is € 1.4 million. The main anchors are two supermarkets: Jumbo (2,000 m2) and the Lidl (1,800 m2), together with a number of daily grocery shops. The weighted average lease term (WALT) is 7.7 years. Centrumplan is a good fit with the ‘Convenience’ element of the Fund’s strategy, which includes investments in local shopping centres with a healthy catchment area, anchored by supermarkets, with ample parking facilities and a retail mix geared towards daily shopping needs. Centrumplan opened in September 2018.

Divestments

In 2018, the Fund budgeted € 30 million for the divestment of non-core assets. These assets do not fit our strategic requirements due to their location, size or economic outlook. The Fund sold two high street retail asset in Den Bosch. In addition, the Fund took further steps in its sales programme, and expects to complete the sale of two non-core assets in the first half of 2019.

Redevelopments

The Munt shopping centre, Weert

In 2018, the Fund started on the upgrade of the Munt shopping centre in Weert. The key points of this renovation are: transparency and a modern look and feel for retailers. The biggest change will be on the Nieuwe Markt side of the centre, where we are renewing the facade and adding a transparent, double-height entrance. We are also renewing the shopping passages, entrances and facades. The Munt shopping centre has 16,414 m2 of retail space divided over 50 retail units. H&M has signed a lease for around 70% of the space from the former V&D department store. Other stores are occupied by fashion retailers, such as WE, Cool Cat, Miss Etam and C&A, but the centre also offers anchor supermarket Albert Heijn and a complete offering of fresh goods. Completion is expected in mid-2019.

Goverwelle shopping centre, Gouda

In 2018, the Fund started on the expansion and upgrade of the Goverwelle shopping centre in Gouda. The 1,000 m² extension will create space for the expansion of the Albert Heijn supermarket and for the addition of a second, complementary, discount supermarket, Dirk van der Broek. It will also add additional parking facilities for 235 cars. A number of the current retail tenants have also agreed to make substantial investments in upgrades to their own stores. This expansion and modernisation project will shift Goverwelle from Other retail to the Convenience part of our portfolio and make the centre future proof. Completion of this redevelopment is expected in the third quarter of 2019.

Active asset management

In addition to its redevelopment activities, the Fund also carried out active asset management in other assets in the portfolio. For example, the Fund made progress on the rental front in the Promesse asset in Lelystad, mainly due to the arrival of anchor HEMA with a 1,163 m2 store. In line with modern retail concepts, this retailer will incorporate a food and beverage element within the store. The addition of retailer HEMA also strengthened the rentability of surrounding retail units thanks to the improved of footfall in the shopping centre for existing and potential tenants. The arrival of HEMA did not go unnoticed. After this lease, other new leases and renewals followed, including leases with retailers Jamin and The Phone House, optician Specsavers and travel agency TUI Nederland. Thanks to this active asset management, the Fund managed to maintain a high occupancy rate 91.7% in this asset, compared with 85% for Lelystad city centre as a whole, which is creating fierce competition on the rental market.

The development and realisation of specific rental strategies is another good example of our active asset management approach. This approach led to a good deal of leasing activity in the Stadionplein (Amsterdam) and Parkweide (Ede) shopping centres. The occupancy rate for these assets increased to 100% in 2018, compared with 89.9% and 91.3% respectively in 2017.

In 2018, we also tried out new leasing ideas to keep our tenant mix fresh to drive traffic and attract new visitors. One good example of this is the 'Win your store' initiative, which makes it easy for new entrepreneurs to open a store in one of our assets. They simply pitch an idea for a chance to win their own store ready to be fitted out, with a six-month rent-free period and free support from a financial expert. During the six-month period, we evaluate the potential of the new store and gain insight into the turnover data. Then we use this data to assess the possibility of forging a long-term relationship with the new tenant.

Portfolio diversification

Portfolio composition at year-end 2018:

Total value of investment property € 958 million (63 properties)

258,530 m² of lettable floor space

Two redevelopment projects

One new property added to the portfolio

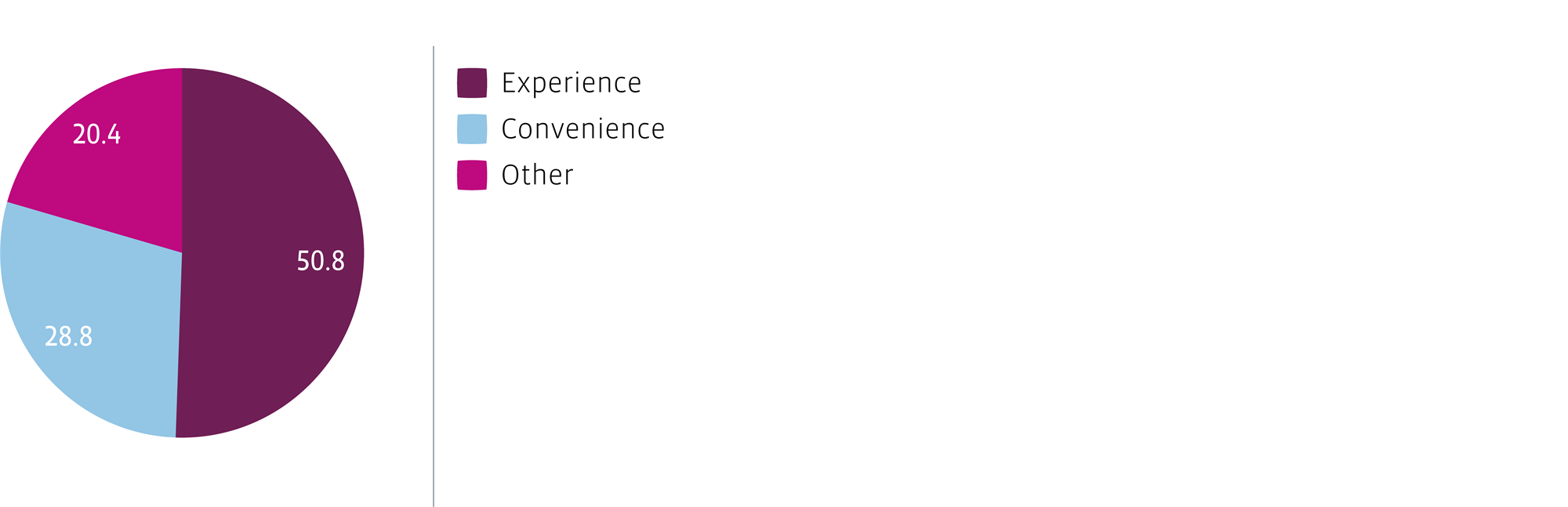

Allocation by strategy

At year-end 2018, the Fund's total portfolio consisted of a total of 63 assets. Of these, 26 assets are classified as Experience and 21 assets are classified as Convenience. The category ‘Other’ consists of 16 retail assets that do not fully meet our strict Experience and Convenience criteria. The Fund's ambition is to increase the share of Experience and Convenience to at least 80% of the portfolio value. In line with this ambition, in 2018 the Fund realised a 2.6% increase in the share of Experience and Convenience, which rose to 79.6% from 77.0%, which is now close to the strategic plan.

Allocation of investment property by strategy based on book value

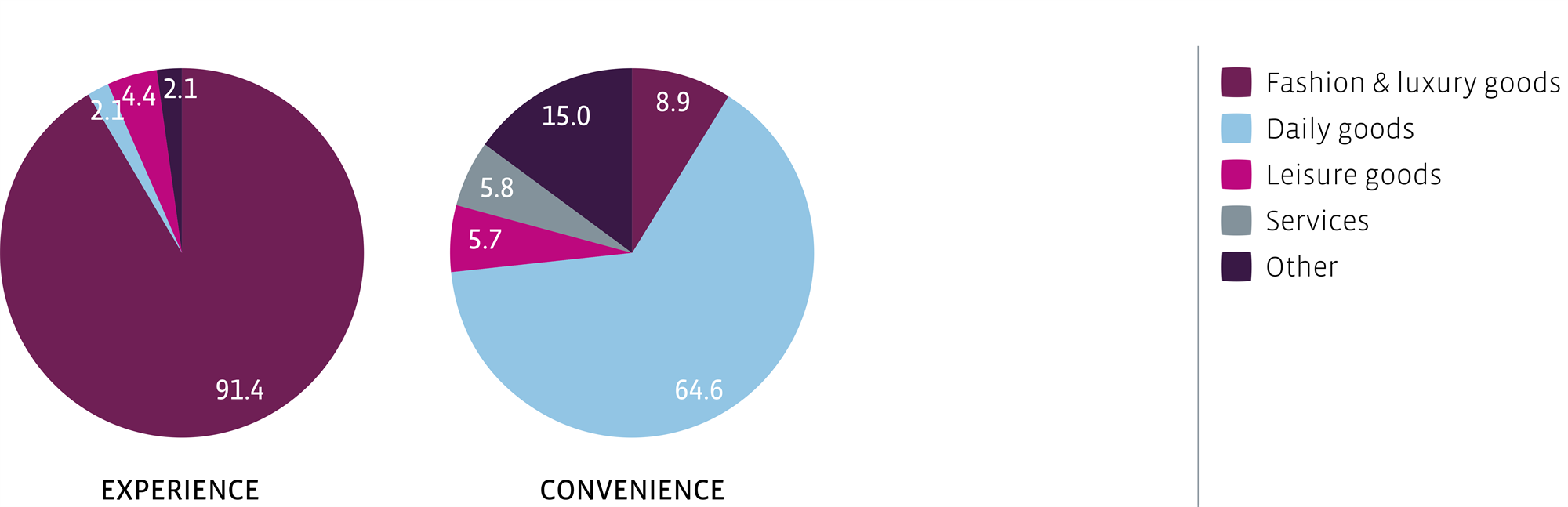

Tenant mix

The Fund’s portfolio includes a wide range of tenants by segment type. In 2018, in the Experience part of the portfolio the share of the segment 'fashion & luxury goods' increased to 91.4% (2017: 91.1%). In the Convenience part of the portfolio, the share of the segment 'daily goods' increased to 64.6% (2017: 60.0%).

Allocation of investment property by tenant sector as a percentage of rental income

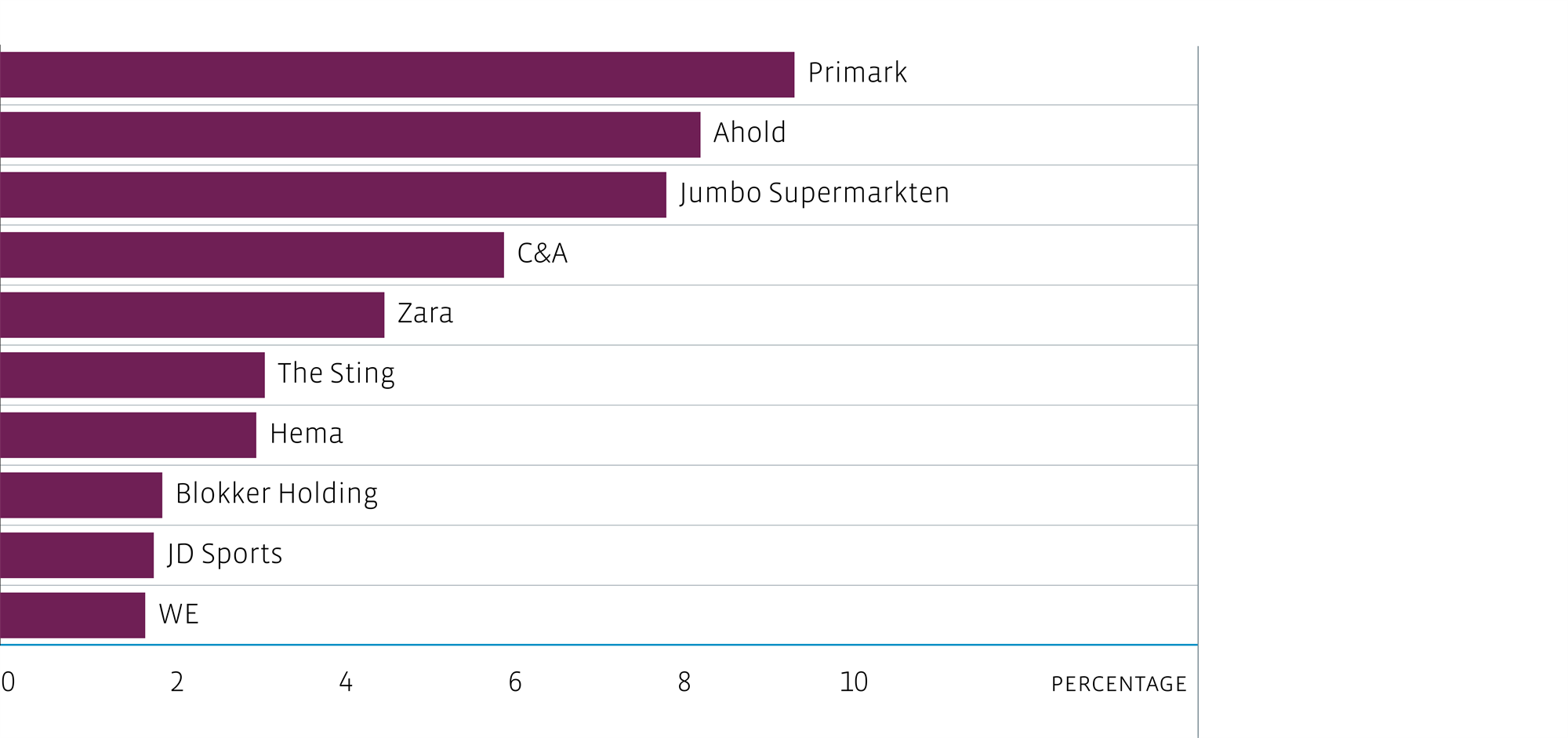

The top 10 major tenants accounted for a total of 47.3% of the theoretical rent in 2018 (2017: 45.3%). The ranking changed substantially due to the purchase of 13 supermarkets, 11 of which are leased to food retailer Jumbo. Jumbo has now moved to number 3 from number 5 in the top 10. Retailer HEMA also rose from tenth to seventh place following two new leases in the portfolio and the acquisition of the HEMA store in Tilburg. The total rent of HEMA increased substantially by 1.3% to 3.0% of the Fund's total rental income. Primark still tops the list, accounting for 9.3% (2017: 9.8%) of the Fund's total rental income.

Top 10 major tenants based on theoretical rent

Expiry dates

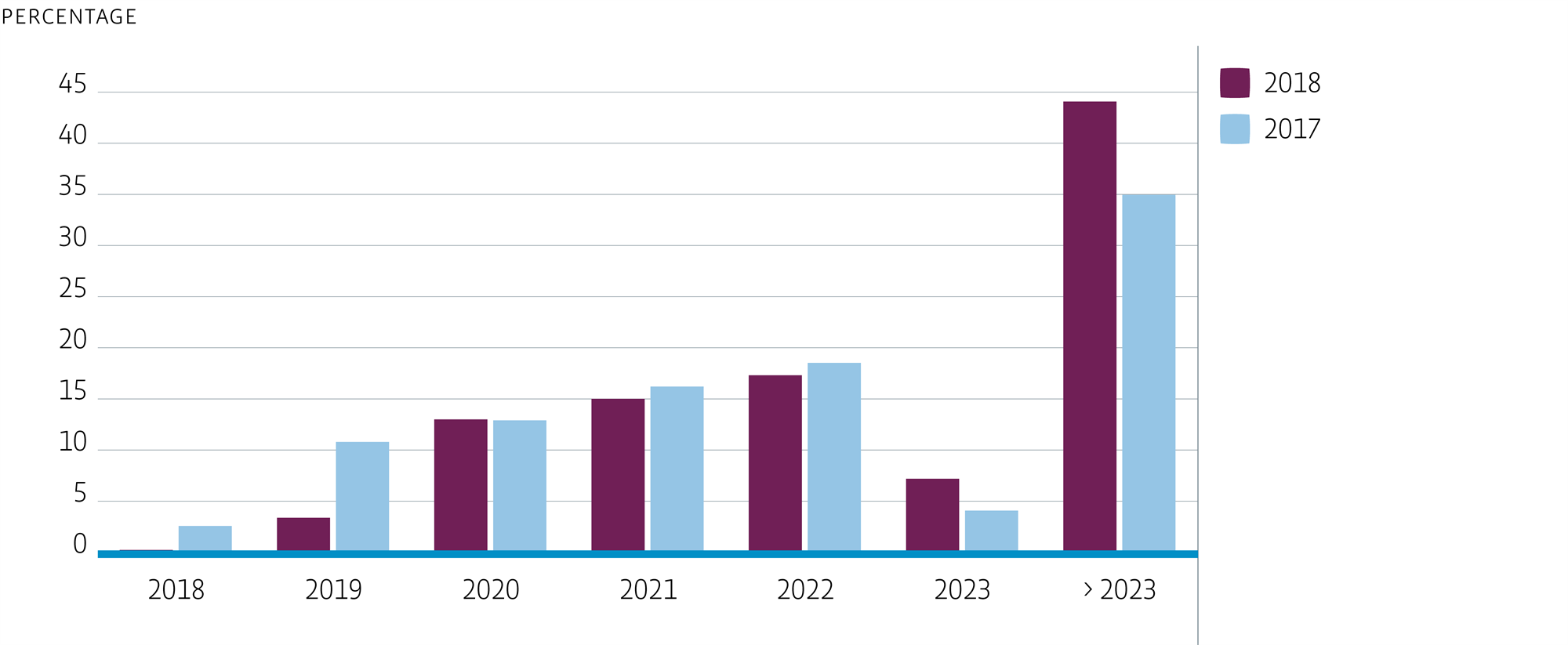

The overview of expiry dates shows a gradual division in the coming years. By the end of 2018, more than 44% (2017: 39.2%) of the total rental income was due to expire after 2023, which means the Fund’s expiration risk remains very low. The average remaining lease term of the total portfolio at year-end 2018 was 6.4 years (2017: 6.5 years).

Expiry dates as a percentage of rental income

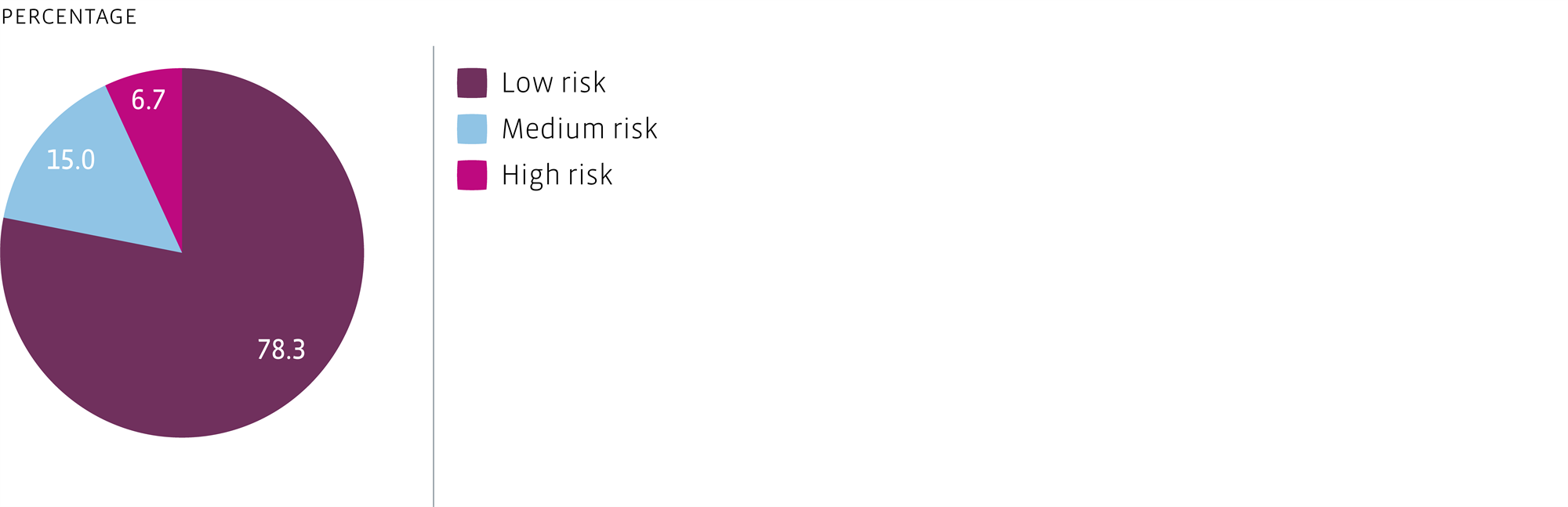

Allocation by risk

In terms of risk diversification, at least 90% of the investments must be low or medium risk. The actual risk allocation as at year-end 2018 is shown in the figure below. We assess all properties separately an an annual basis.

Allocation of investment property by risk based on book value

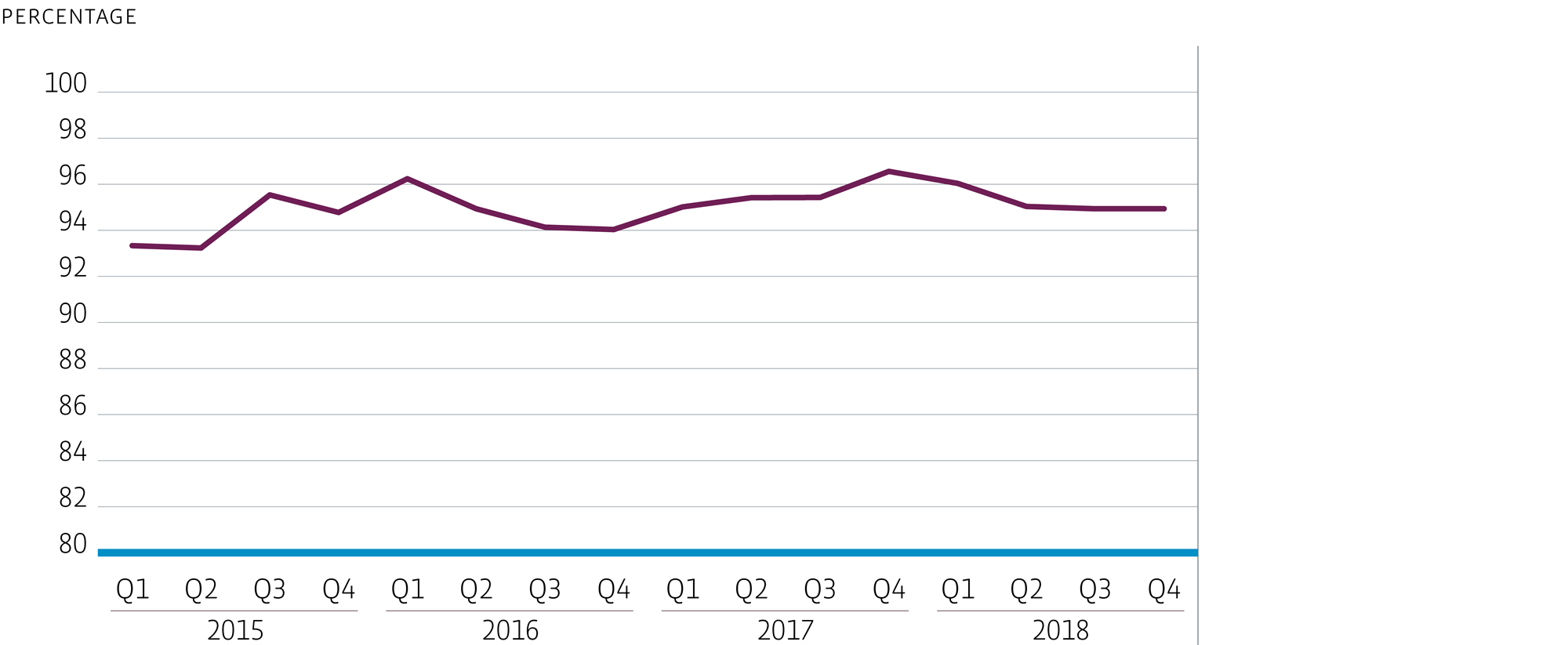

Financial occupancy

The Fund managed to maintain the occupancy of the portfolio at a high level. The average occupancy rate ended at 95.2% in 2018 (95.6% in 2017), which was 0.4% lower than the 2018 budget. Strategic vacancy due to the renovation and expansion activities in the Goverwelle shopping centre and De Munt shopping centre in Weert, have temporarily reduced the occupancy rate of the portfolio. The Fund closed 112 new lease contracts and renewals, representing a total of € 5.3 million in annual rent.

Financial occupancy rate