Portfolio characteristics

€ 958 million in Dutch retail properties (63 assets, 258,530 m2 NLA) at year-end 2018

High-quality retail assets divided into Experience and Convenience

Continuously high occupancy rate

Continuous outperformance of the MSCI Property Index

GRESB 4-star rating

Investment property

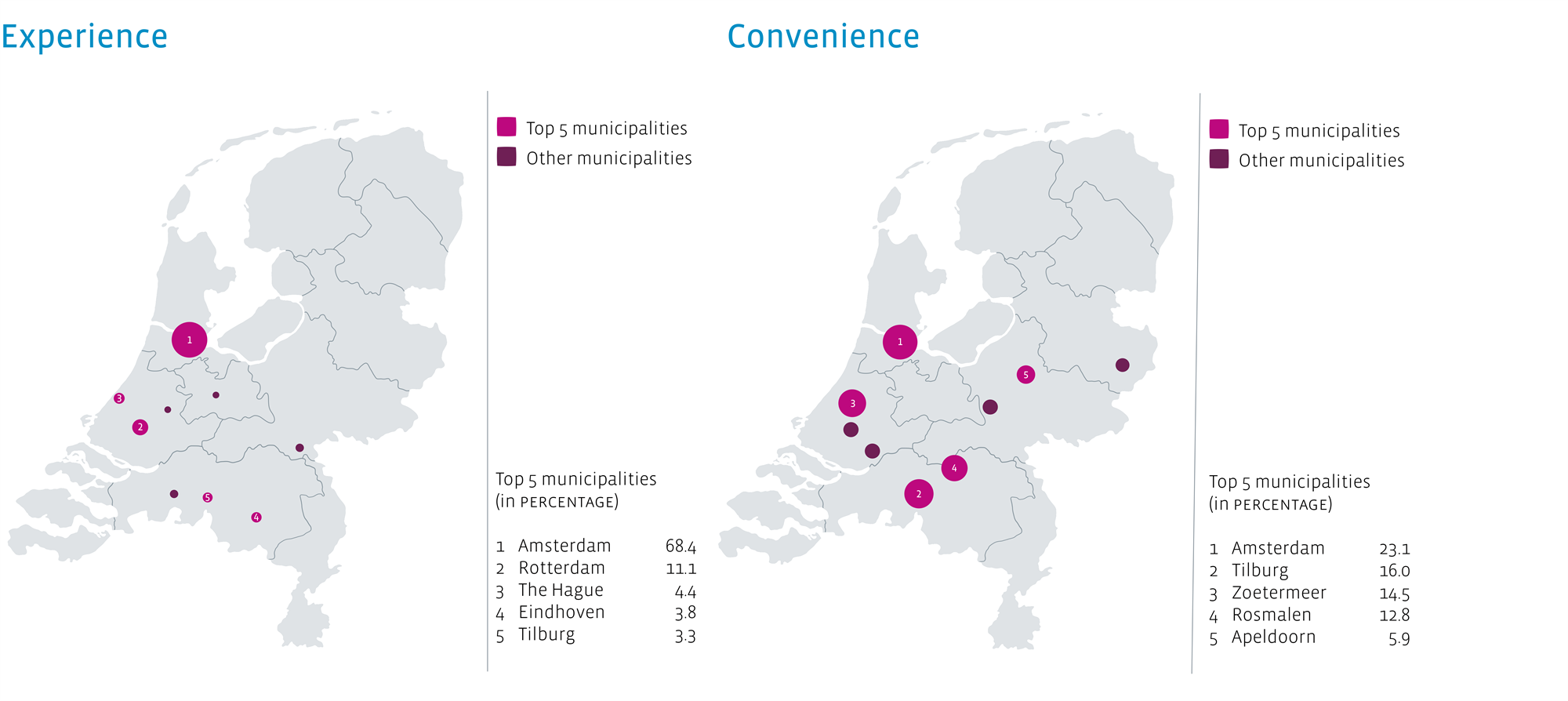

Major segments

The Fund’s diversification strategy is based on the belief that the future of retail real estate will be determined by two very distinct segments of the market: high street shopping areas that offer consumers a distinctive Experience and district shopping centres or stand-alone supermarkets that provide very high levels of Convenience.

EXPERIENCE - High street retail in best shopping cities

The main focus of the Fund’s Experience portfolio is on individual high street shops or clusters of shops in prime shopping areas in major Dutch city centres. These city centres have retained their market share and will continue to do so in the future. Shopping for fashion and lifestyle products is changing drastically. Because consumers now have a wider choice in terms of how they buy fashion and life-style products (online or offline), the differentiating potential of shopping cities is becoming an ever greater factor in their success. The presence of food and beverage is playing an increasingly important role here. Consumers prefer cities that offer cultural attractions and a wide range of catering establishments, in addition to a varied range of fashion and lifestyle stores. The combination of these factors creates attractive locations offering the experience factor that contemporary consumers see as an essential part of a day of shopping. We believe that shopping cities offering this fun or ‘Experience’ factor will be the most future-proof.

For strategic asset management and acquisition purposes, Bouwinvest and its Research department have developed a ranking tool for the best shopping cities and high streets in the Netherlands on the basis of footfall, catchment area, consumer numbers, rent per m2, vacancy rates and average income. The best shopping streets are determined using Bouwinvest's Top shopping streets ranking, which provides an overview of the most attractive shopping streets in the Netherlands, including shopping streets outside the Top 15 shopping cities. We look at indicators at regional, shopping area and street level. These include indicators such as (growth in) the number of residents in a catchment area, the average income level, the number of tourists, the presence of the hospitality sector and the number of passers-by.

CONVENIENCE - Shopping centres and stand-alone supermarkets with strong catchment areas

The main focus of the Fund’s Convenience portfolio is on district shopping centres and standalone supermarkets with healthy catchment areas, together with assets in a rapidly emerging new retail segment, stores in high-traffic locations. Retail real estate with a functional range of goods (daily shopping) with a focus on convenience remains an interesting investment segment.

A healthy catchment area is the main factor in the success of any shopping centre or supermarket with a focus on daily shopping needs. The size – and health – of a catchment area can be affected by the regional economy, the local and regional demographic outlook and competing retail stock. A healthy regional economy guarantees employment and income growth, while demographic growth has a visible impact on a shopping centre’s potential market. On the other hand, new retail stock may lead to a serious reduction of the catchment area for existing supermarkets and shopping centres.

The Fund focuses on a number of additional factors that increase the level of convenience so prized by today’s consumers, an element that the Fund believes will become ever more important in the future. These additional criteria include easy accessibility, comfort parking, an effective tenant mix, plus the overall look and feel of the centre. The Fund needs to constantly monitor and respond to demographic changes, such as average age or household size, through the continuous optimisation of retail properties and their tenant mix. One essential part of the retail mix is one or two clear, complementary and well-positioned supermarket anchors, as these act as a major pull factor for convenience shoppers. Supermarkets have so far shown limited vulnerability to online sales and are virtually unaffected by other stores in their vicinity.

An effective retail mix with various specialist stores is another factor that makes shopping centres attractive to consumers. Due to market changes and the ongoing growth of online sales, the number of non-food shops in these centres will decline even more in the near future. The Fund is therefore also focused on actively revitalising its convenience centres by increasing the average share – measured in square metres and in cash flow – accounted for by supermarkets, shops selling daily goods and deliveries, and reducing the number of non-core units.

Portfolio composition by segment as a percentage of market value

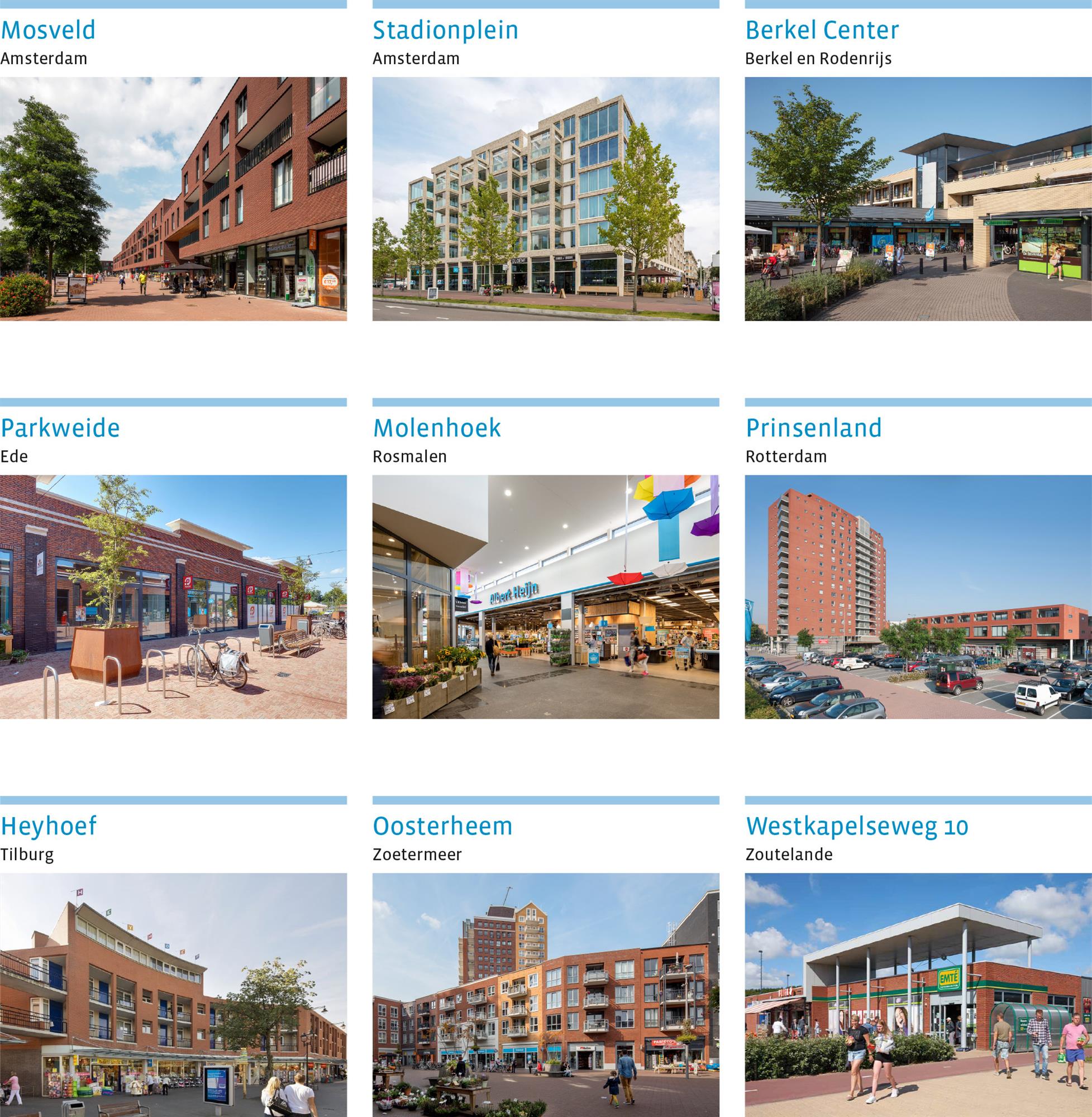

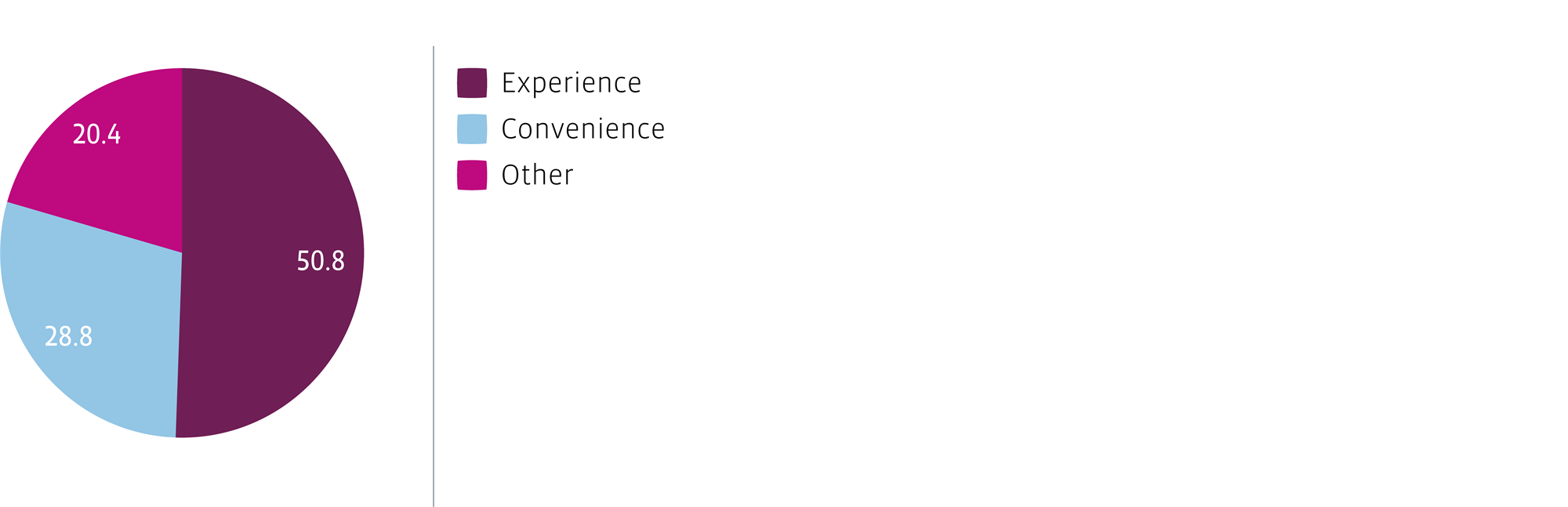

Selection of principal properties

Experience

Convenience