Overview of Fund plans

| | Plan 2018 | Result 2018 | Result 2017 |

Income return | 2.5% | 2.6% | 2.8% |

Capital growth | 6.7% | 15.6% | 12.8% |

Total Fund return | 9.2% | 18.1% | 15.6% |

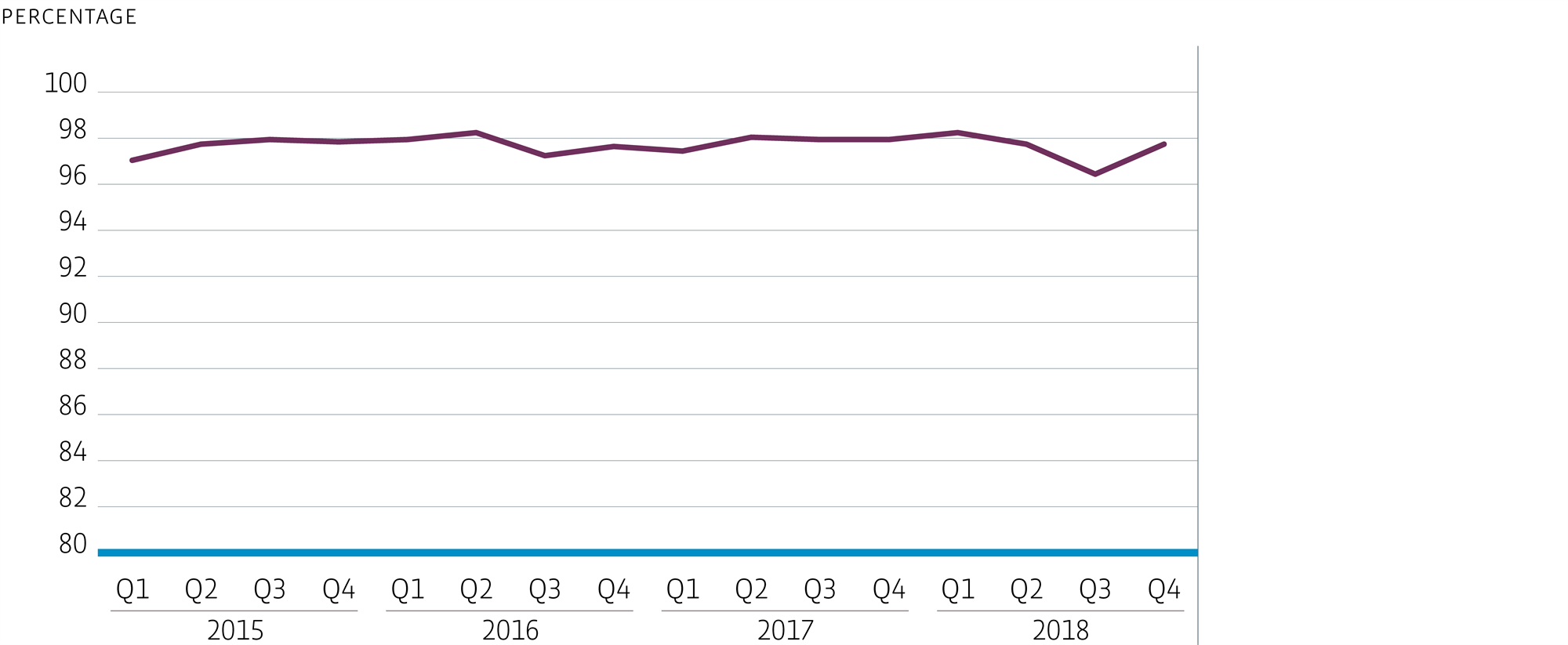

Occupancy rate | 97.1% | 97.5% | 97.8% |

Investments | € 200 million | € 432 million | € 244 million |

Divestments | € 75 million | € 46 million | € 63 million |

Funding | € 350 million | € 433 million | € 215 million |

Investments and divestments

Acquisitions

As a result of our active focus on the acquisition of new properties, we were able to make 12 excellent high-quality acquisitions in 2018. Investments totalled around €480 million in 2018, which was €280 million above plan. We acquired a total of 1,447 homes (1,279 apartments and 168 family homes). Besides the purchase price, matters such as reliability, vigour and expertise are highly appreciated in the market. It is very important to also stand out in deal security, efficiency and rapid (legal) structuring and decision-making. All these aspects played a role in achieving these results. The acquisitions are funded by the commitments of new shareholders, a top-up of commitments by existing shareholders and through divestments. All of the acquisition properties are located in the Fund's core regions, with six (1,272 homes) located in the Randstad:

The assets we acquired in 2018 are described below.

Sluishuis, Amsterdam

Expected rental bandwidth: € 915 - € 1,430 (price level 2022)

The Sluishuis apartment building consists of 72 owner-occupier apartments and 369 liberalised rental apartments of which 221 will be rented out in the mid-rental segment. The apartments vary in size from 40 m2 to 80 m2. The Sluishuis complex will include space for a lunch cafe or restaurant and mooring for a number of houseboats. It is located at the head of the Steigereiland, the first part of IJburg, right next to the access/exit from Amsterdam’s A10 ring road. Delivery is scheduled for 2022.

Hembrug Zaanstad

Expected rental bandwidth: € 875 - € 1,465 (price level 2022)

The Hembrugterrein is a former Ministry of Defence site with around 43 hectares of land. This site is marked by its unique combination of industrial listed buildings and plentiful greenery. Together with the short distance to Amsterdam, this site is exceptionally suitable for the development of an attractive residential environment. The plan includes around 1,000 homes, together with commercial spaces. The residential component will comprise 350 newly build liberalised sector rentals, around 450 owner-occupier homes and roughly 200 government-regulated rentals. Delivery is scheduled for 2022.

De Monarch, Hoofddorp

Expected rental bandwidth: € 945 - € 1,260 (price level 2021)

The De Monarch project in Hoofddorp comprises an apartment building with 97 apartments, varying in size from 81 m² to 111 m², with 141 dedicated parking spaces. De Monarch is centrally located in Hoofddorp, on the edge of the existing Toolenburg neighbourhood. The complex is located amidst (new build) homes, a senior school and a sports complex. Residents will have access to various retail options and nearby cultural and recreational facilities, as well as good public transport connections. Delivery is scheduled for end-2020.

Ebbingekwartier 7 & 9A, Groningen

Expected rental bandwidth: € 865 - € 1,245 (price level 2020)

The Ebbingekwartier is a new-build residential area in the former CiBoGa (Circus, Boden & Gas) site in Groningen. The project is located next to the Student Hotel, just a few minutes’ walk away from the centre of Groningen. The two complexes in the Ebbingekwartier (buildings 7 and 9A) comprise a total of 59 apartments varying in size from 55 m² to 87 m². The ground floor of building 9A will be used as commercial space, with a child day-care centre and a branch of property developer Van Wonen. Delivery is scheduled for 2020.

Zonnehoeve, Apeldoorn

Expected rental bandwidth: € 1,030 - € 1,230 (price level 2019)

Zonnehoeve Apeldoorn is a site in the green environment to the east of Apeldoorn, with other developments in the immediate environment. These 41 houses have an average floor space of 143 m² and offer ample space for young families. The project is located on the Groene Voorwaarts road, with the A50 a two-minute drive away and railway station De Maten a one-minute cycle or six-minute walk away. Delivery is scheduled for 2019.

Velperparc, Arnhem

Expected rental bandwidth: € 915 - € 1,190 (price level 2020)

The Arnhem Velperweg project comprises an apartment complex on the former Nederlandse Kunstzijdefabriek (eNKa) factory site. This complex consists of 36 homes varying in size from 75 m² to 109 m². The Velperpoort railway station is a four-minute cycle-ride away and the A12 motorway is a seven-minute drive away. Delivery is scheduled for end-2019.

Houthavenkade, Zaanstad

Expected rental bandwidth: € 880 - € 1,320 (price level 2022)

The Houthavenkade project is in a central location in Zaandam, at the edge of the city centre. On the east side, the location is adjacent to the port with its connection to the so called Voorzaan, while on the south-west, the site is adjacent to the Provincialeweg and the Ahold head office. The location is currently still home to companies and light industry. The project comprises an apartment complex of 284 apartments, varying in size from 49 m2 to 115 m², 199 parking spaces and 354 m² of commercial space. The project will help respond to the housing demand in Zaanstad and its core Zaandam and, like the Hembrug project, provide opportunities for home seekers from elsewhere in the Amsterdam metropolitan area. Delivery is scheduled for 2022.

Zandven & Huysackers, Veldhoven

Expected rental bandwidth: € 1,050 - € 1,175 (price level 2020)

The Zandven location (22 houses of around 122 m²) is the final section of the expansion of the De Kelen neighbourhood. The Huysackers location (17 houses varying in size from 120 m² to 135 m²) is the first phase of the expansion of the Zilverackers neighbourhood. The entire area, with a total of 430 new homes, is highly sustainable and all the homes will be energy-neutral. The neighbourhood is also within easy cycling distance of the shops on Kromstraat and various schools and sports facilities. Delivery is scheduled for 2020.

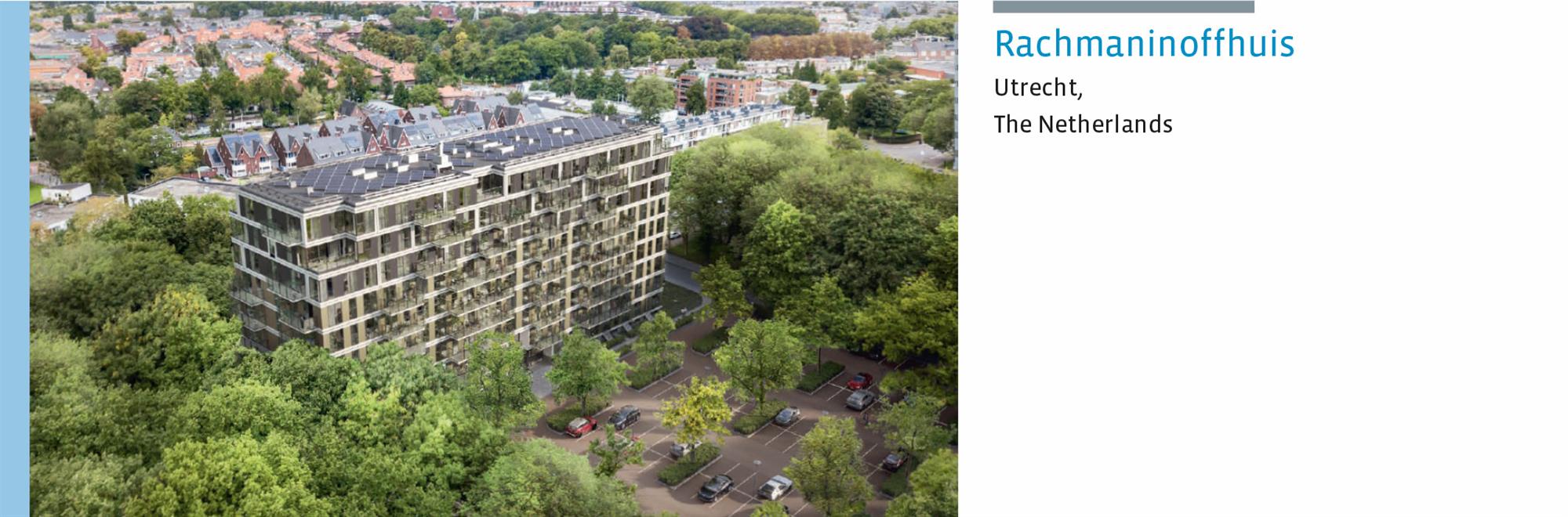

Rachmaninoffhuis, Utrecht

Expected rental bandwidth: € 925 - € 1,445 (price level 2020)

The Rachmaninoffhuis is located in the green area of Welgelegen, a neighbourhood that is transitioning from an office environment to a mixed residential and work area with a direct connection to the Oog in Al neighbourhood. The project involves the transformation of former city offices into a residential building with 132 apartments. The project is less than a 10-minute bike ride from the Domtoren at the heart of Utrecht’s city centre. A total of 53 of the apartments (40% of the project) will be rented out in the mid-rental segment. Delivery is scheduled for 2020.

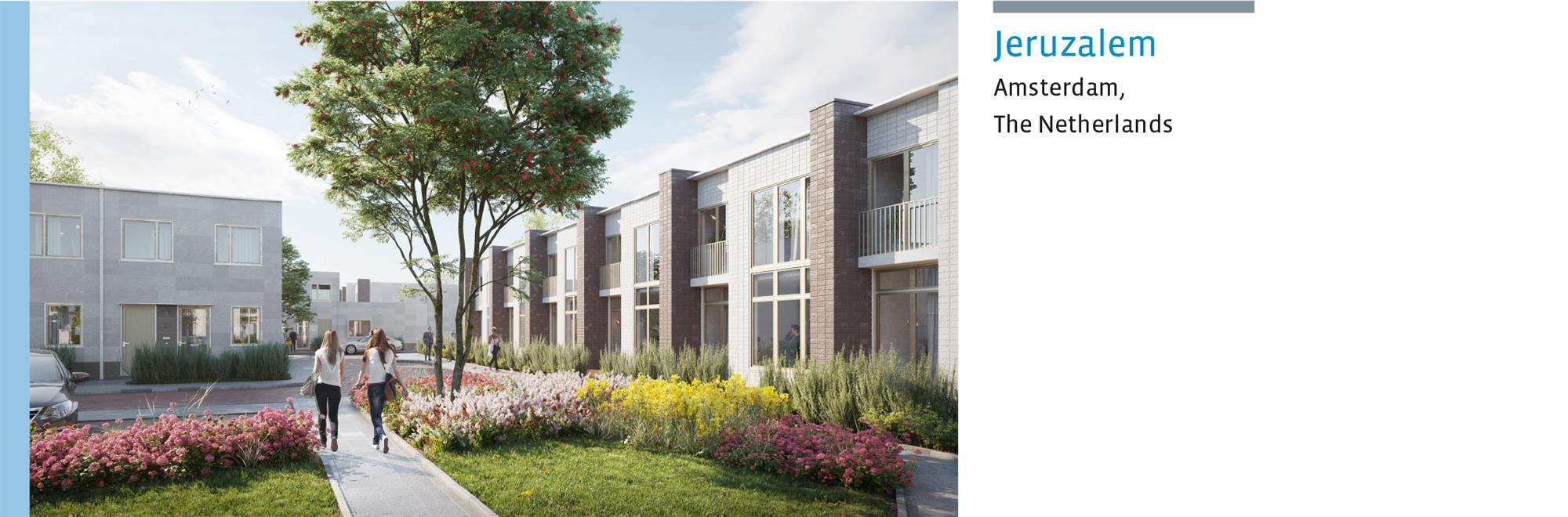

Jeruzalem, Amsterdam

Expected rental bandwidth: € 1,375 - € 1,820 (price level 2020)

The Park Jeruzalem plan entails the redevelopment (demolition / new construction) of the G and H blocks in the Watergraafsmeer area in the east of Amsterdam. The site is located in Tuindorp Frankendael/Jeruzalem and is immediately adjacent to Park Frankendael. The project comprises 38 family homes, ranging in size from 98 m² to 104 m², two apartments of 77 m² and 108 m² and one 93-m² commercial space. The homes will be built around a communal garden, designed in the style of landscape architect Mien Ruys. The project is in the vicinity of Bouwinvest properties Jeruzalem block I, with 24 houses (Residential Fund), and the Ingenhouszhof (Healthcare Fund). Delivery is scheduled for 2020.

Investments

In 2018, the Fund added a total of 906 apartments and 211 family homes to its portfolio. See below for a list of the new properties in the portfolio.

Properties added to the portfolio

Property | City | No. of residential units |

Malburgen Nieuwe A | Arnhem | 29 |

Pontsteiger | Amsterdam | 252 |

Bloemfontein (De Werf B) | Amsterdam | 28 |

Doha (De Werf D) | Amsterdam | 62 |

Parking (De Werf H) | Amsterdam | 0 |

Parc Valere | Helmond | 75 |

Vrij Werkeren | Zwolle | 46 |

Liverdonk | Helmond | 26 |

Ceuta (De Werf C) | Amsterdam | 180 |

Ivens Studios | Amsterdam | 70 |

Zijdebalen III | Utrecht | 73 |

Vredenburgplein | Utrecht | 11 |

State II (Kop Weespertrekvaart) | Amsterdam | 102 |

Elias Beeckman Kazerne | Ede | 64 |

De Kreek | Oosterhout | 30 |

De Grassen I | Vlijmen | 23 |

Van der Marckhof | Utrecht | 46 |

Divestments

In 2018, the Fund signed two agreements for the sale of a total of seven properties (437 family homes and 171 apartments) for an amount of approximately € 127.5 million, which was higher than the asset value. One property has already been delivered, resulting in a divestment of € 46 million in 2018. Delivery of the other six properties will take place in the first quarter of 2019. As our acquisitions in 2018 were higher than the plan, we increased our divestments slightly. The decision to sell residential complexes is largely driven by the returns they are expected to generate over the next ten years. Factors that lead to the decision to sell include the location, the product/market combination, the potential to increase the rents and the local rental market.

Following our annual hold-sell analysis, Bouwinvest decided to sell the following properties:

Properties sold

Property | City | No. of residential units |

De Witte Keizer | Rotterdam | 107 |

| | | |

*West Ede | Ede GLD | 116 |

*Peelo I | Assen | 92 |

*Hagerhof West | Venlo | 73 |

*Hoogeveen | Hoogeveen | 64 |

*Brouwerhof Zuid | Valkenswaard | 116 |

*Tolberg | Roosendaal | 40 |

| | | |

* contract signed, delivery in Q1 2019 | | |

Active asset management

A key element of Bouwinvest’s active asset management approach is our continuous efforts to achieve an optimal fit with tenants’ needs through engagement with our tenants and their evolving housing desires as identified by the marketing and asset management team. Bouwinvest has therefore divided the tenant population of the portfolio into six specific customer segments. These segments differ significantly and are based on lifestyle, housing ambition and housing preferences.

We are convinced that our marketing approach is one of the reasons that almost all new properties added to the portfolio were fully let before completion and the overall average long-term financial occupancy rate is 97.5%.

Among other things, the active asset management activities led to:

Optimised rent levels by using the market opportunities we identified

Reduction of regulated rental contracts

Increasing sustainability through the placement of solar panels at a number of properties and measures aimed at increasing sustainability during maintenance activities

Portfolio diversification

Portfolio composition at year-end 2018:

A total of 17,174 homes (256 properties) across the Netherlands

Total value investment properties of € 5.2 billion

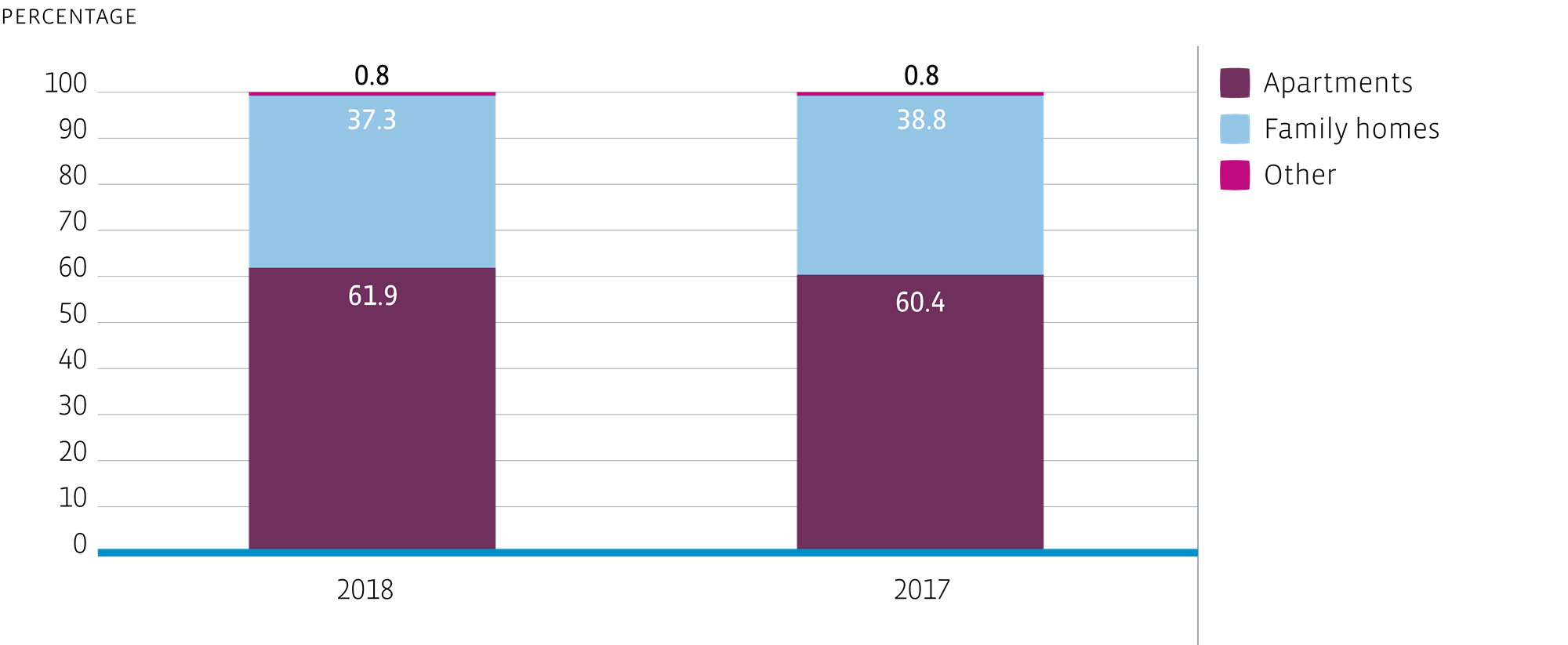

Type of property

The Fund aims for a balanced mix of family homes and apartments, catering for the needs of couples, single occupiers and families alike. In 2018, the Fund bought and sold both family homes and apartments. Compared with 2017, the proportion of apartments in the total portfolio had increased at year-end 2018 (2018: 61.9% 2017: 60.4%). Due to our focus on inner-city areas and the fact that apartment complexes are almost always larger than projects involving houses, the proportion of apartments will continue to grow for the foreseeable future.

Allocation of investment property by type of property based on market value

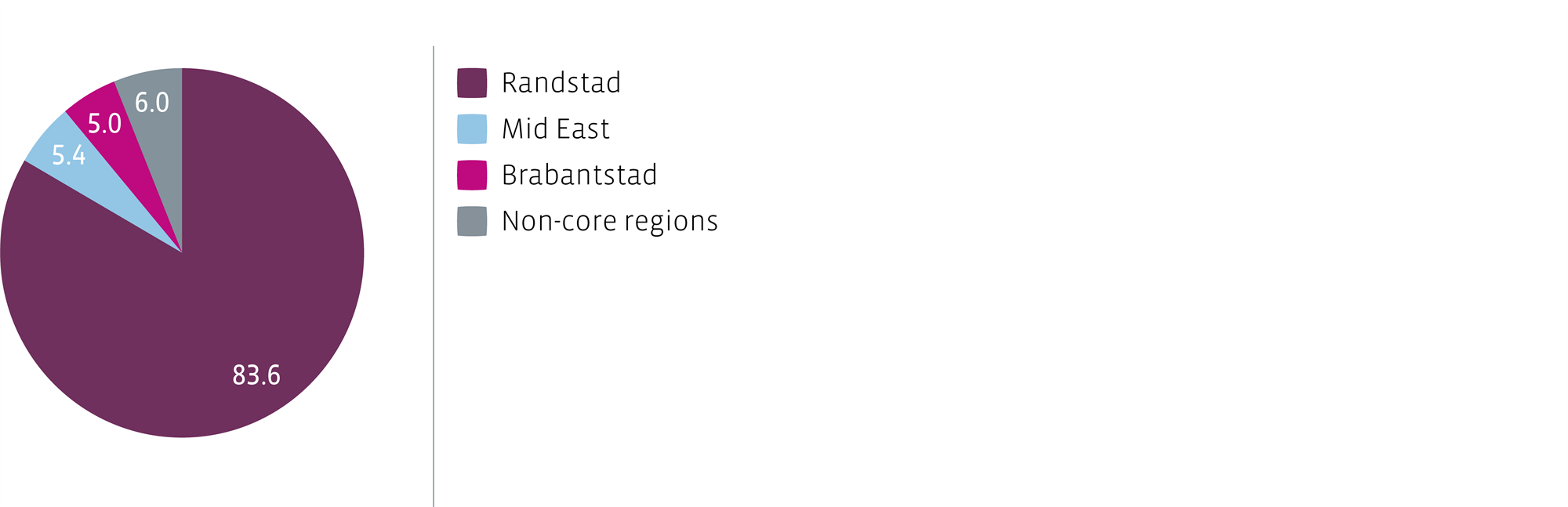

Core regions

The Fund aims to achieve a balanced diversification, with a strong focus on core regions with a positive economic and demographic outlook. The plan is to have at least 80% of the total value of the portfolio concentrated in residential real estate in these core regions. Due to revaluations, together with the acquisitions and divestments we made in 2018, close to 94% of the portfolio value was located in these core regions, with by far the greatest part (83.6%) located in the core region of the Randstad urban conurbation. This is compliant with the Fund's guideline that a maximum of 90% can be invested in the Randstad conurbation.

Allocation of investment property by core region based on market value

The Fund constantly refines its long-term regional focus. This involves anticipating and responding to long-term trends that may affect the value of the portfolio, such as the growth in the number of households, the ageing population and steadily increasing urbanisation. The Fund’s core regions include the Randstad conurbation (Amsterdam, Rotterdam, The Hague and Utrecht), the Brabantstad conurbation (Eindhoven, Den Bosch, Breda and Tilburg) and cities with a strong economic and demographic outlook in the eastern region of the country (Arnhem, Nijmegen, Zwolle en Apeldoorn). These regions are expected to see the greatest population growth and largest increase in the number of households in the coming decades.

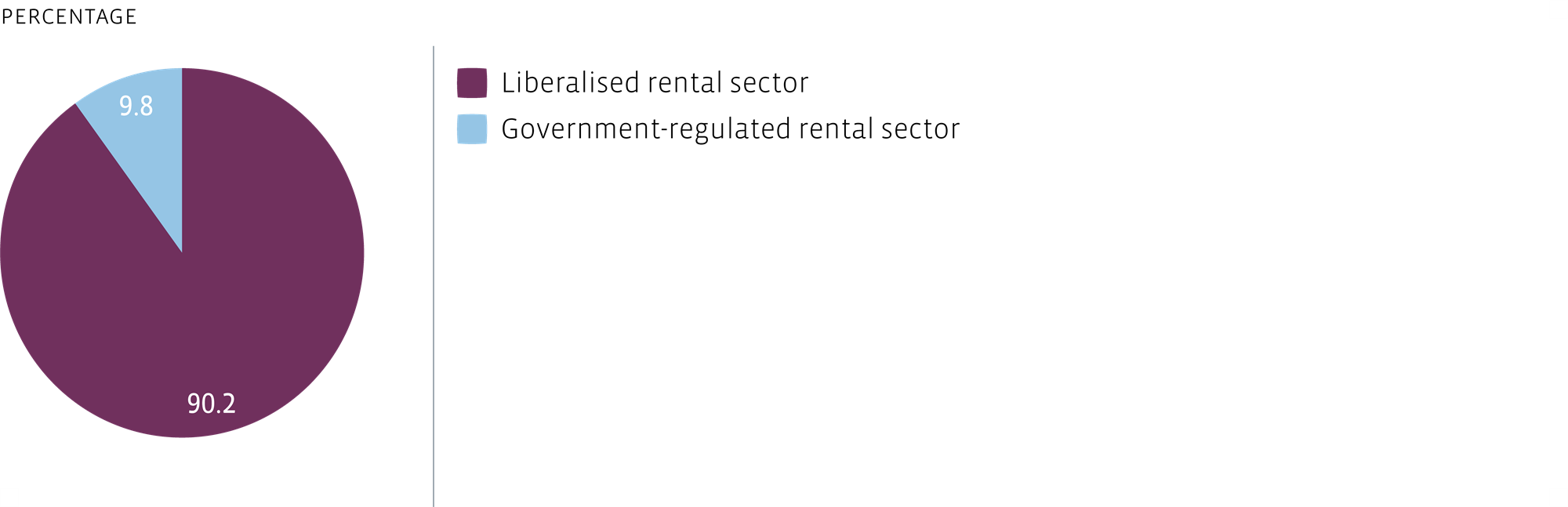

Rental segments

As a result of active asset management, investments and divestments, the percentage of liberalised rental homes in the portfolio increased slightly to 90.2% in 2018, from 88.9% in 2017.

Allocation of investment property by type of rent based on rental contract

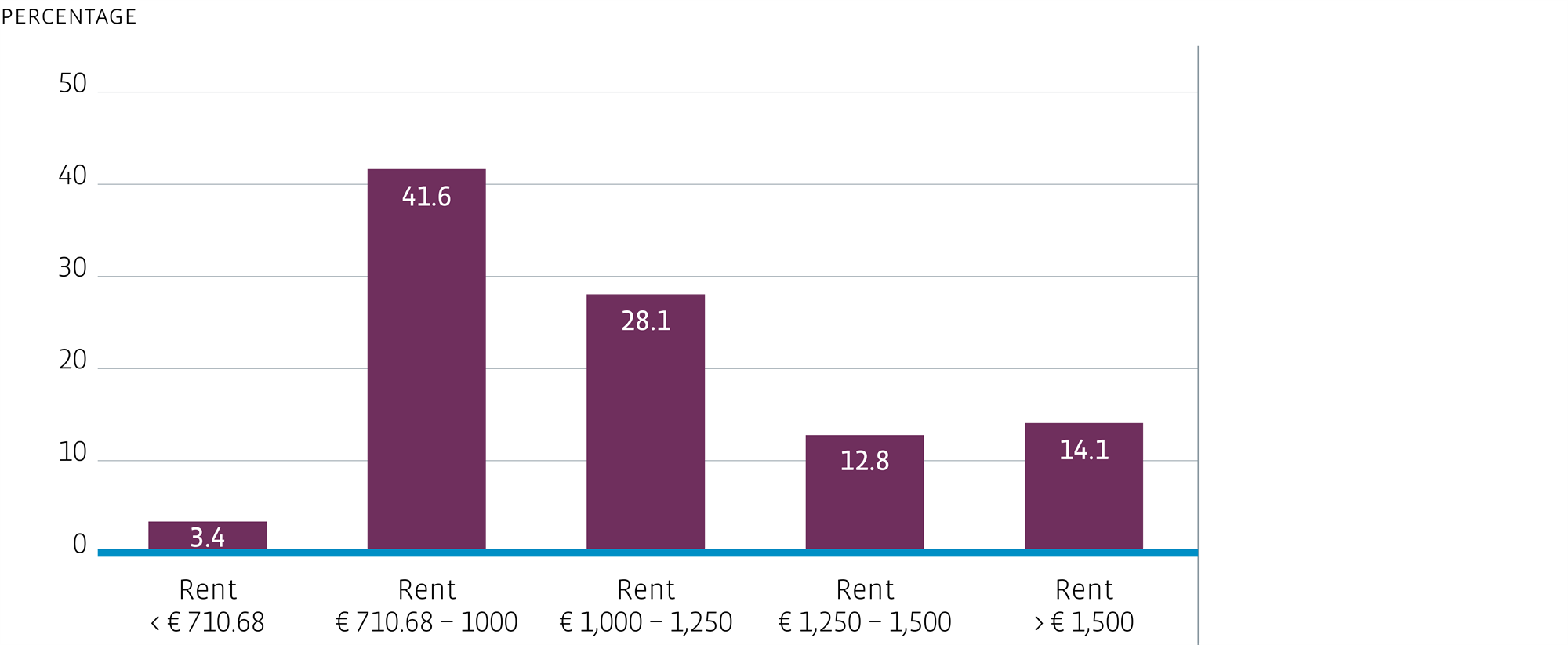

Price level

With a slightly increased average monthly rent of € 1,055 in 2018, the Fund's focus continues to be on the mid-rental segment. Around 73% of the portfolio has a monthly rent of between € 711 and € 1,250 and more than 40% consists of homes in the mid-rental segment (between € 711 and € 1,000). Following the acquisition of 1,447 homes in 2018, mostly in the mid-rental segment, the Fund is well represented in a segment that is in high demand due to the current economic conditions. Individuals, couples and families who no longer qualify for government-regulated rental housing are still finding it difficult to buy homes due to the sharp rise in house prices and the lack of affordable supply, especially in the Randstad. In addition to this, the rental market gives tenants greater flexibility, which is becoming more important as people switch jobs more frequently than ever before. The Residential Fund’s continuing focus on the mid-rental segment has given it a solid portfolio of prime properties perfect for this target group.

Allocation of investment property by price level based on rental income

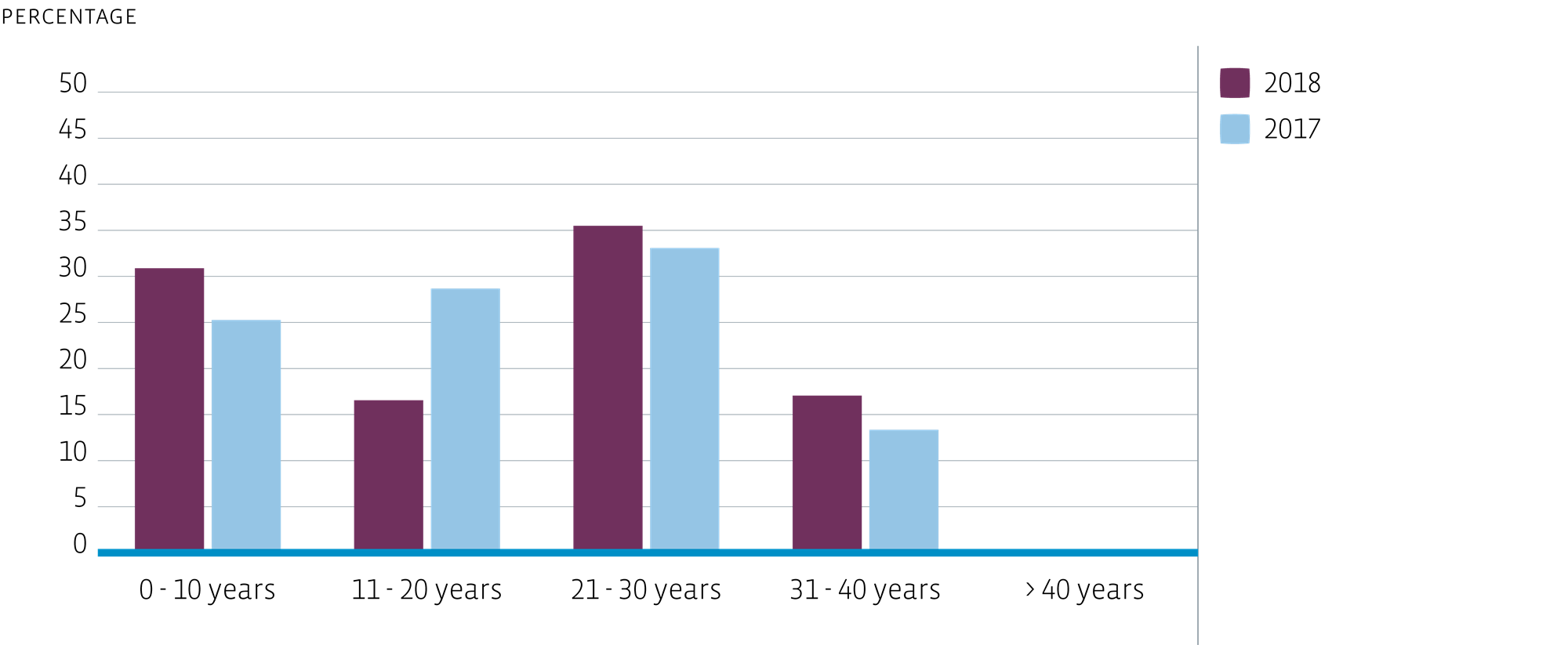

Age

As a result of the refreshment of our portfolio in 2018, the weighted average age of the portfolio increased slightly compared to year-end 2017 (18.2 years in 2018 versus 17.9 years in 2017).

Although we have a disposal plan of around € 300 million for the coming years, the weighted average age of the portfolio is expected to increase in the future, due to the ageing of the total portfolio. Older assets that still generate good returns are held in the portfolio and are kept up-to-date through refurbishments, including new bathrooms and/or kitchens, together with measures designed to increase energy efficiency and cut carbon emissions.

Allocation of investment property by age as a percentage of market value

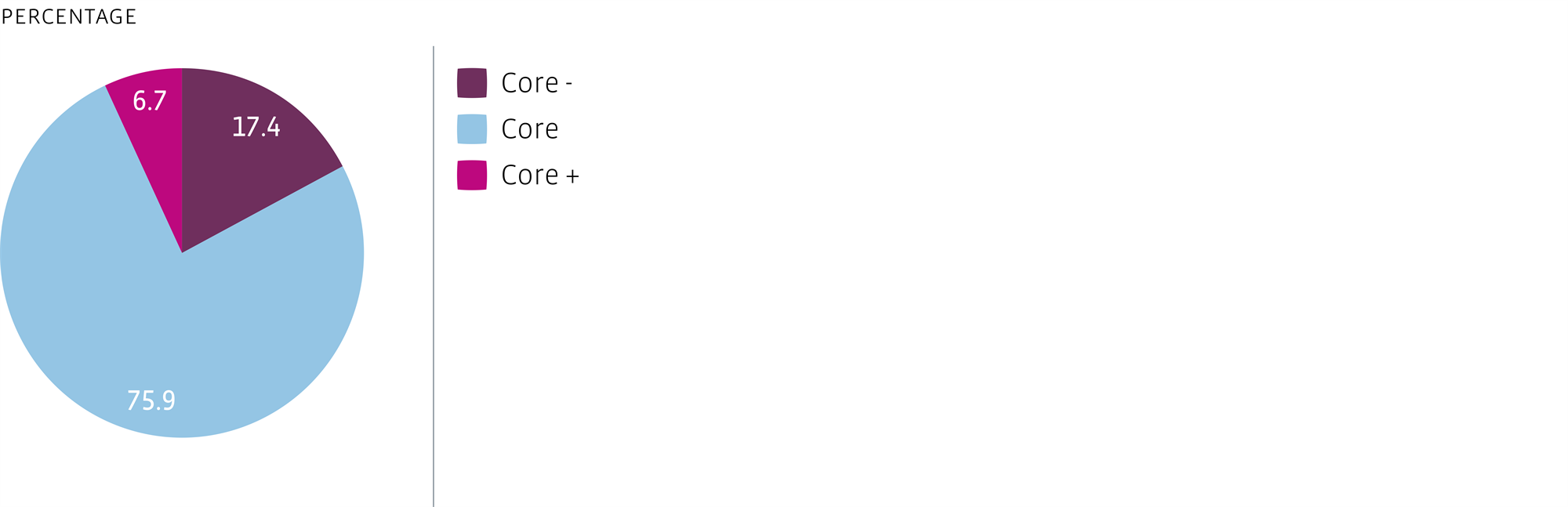

Allocation by risk

In 2018, active asset management of the current portfolio and acquisitions ensured further optimisation of the Fund’s risk-return profile. The Residential Fund has a well-balanced risk profile, with the focus on low-risk assets in the Fund’s core regions.

Allocation by risk

Financial occupancy

A key element of Bouwinvest’s active asset management is our aim to achieve an optimal fit with tenants’ needs by engaging with (potential) tenants and adapting both new and existing homes to the evolving housing desires identified by our marketing and asset management teams. Bouwinvest has therefore divided the tenant population of the portfolio into six specific customer segments. These segments differ significantly and are based on lifestyle, housing ambition and housing preferences.

Furthermore, the Fund is devoting a great deal of time and energy to online lead generation. Potential tenants are increasingly turning to the internet as their (first) search engine for rental homes. On the basis of the customer journeys we mapped out for our target groups, we invested in the optimisation of the rental process and our online presence via the continued development of websites using Search Engine Optimisation (SEO), Marketing Automation and a CRM system. We have now fully digitalised the customer journey for all new-build projects, simplifying the entire process and making it fully transparent, both for us and for our customers.

We are convinced that this approach, combined with high-quality housing products in the best locations, is the main reason that virtually all new properties added to the portfolio were fully let before completion and the overall financial occupancy rate is a very satisfying 97.5%.

Financial occupancy rate