Our sustainable real estate strategy is built on two pillars: certified sustainable assets and the reduction of environmental impact. Sustainable real estate helps to combat climate change and generates broader social, economic, environmental and health benefits. We are convinced that our approach reduces risk, increases client returns and makes our real estate assets and portfolios more attractive.

Sustainable buildings

Sustainable building certificates enable us to show where we are in terms of sustainability at asset level and how far we still have to go. We use internationally accepted sustainability certificates to measure and assess the overall sustainability of our assets. Benchmarks help us to make informed business decisions aimed at mitigating environmental, social and governance risks and to enhance our long-term returns. Certificates such as BREEAM measure criteria that go beyond legislative requirements and provide us with instruments to encourage more responsible tenant behaviour, such as cutting waste and reducing energy consumption.

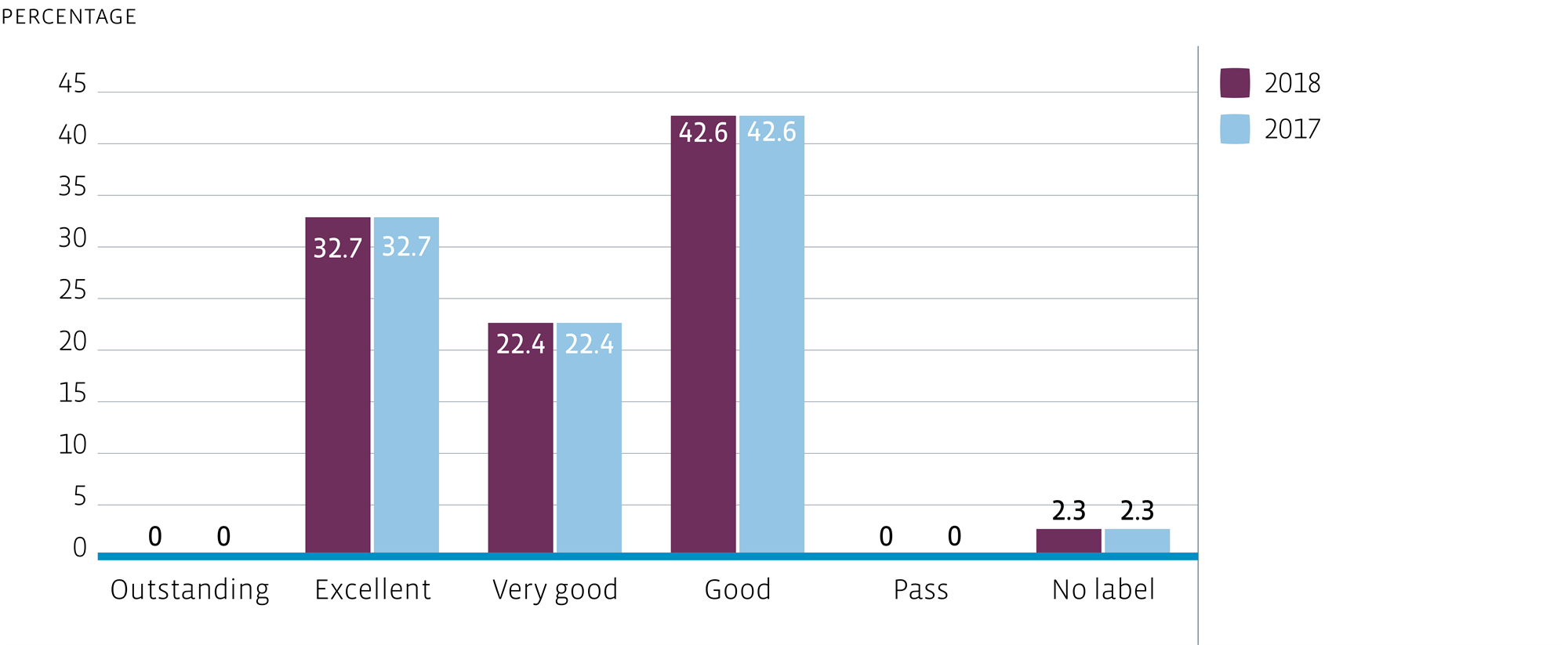

The Fund uses BREEAM to measure and assess the overall sustainability of its buildings. The BREEAM methodology covers a wide range of subjects; from energy to transport, from vegetation and materials to indoor climate quality. This makes it a very useful tool to implement sustainability at different levels within the Fund. The target for 2018 was to achieve a BREEAM ‘GOOD’ rating for every asset in the portfolio. In 2018, in close collaboration with our property managers, we executed a number of improvements to improve GOOD certificates to VERY GOOD at the re-certification in 2019. The high rise section of WTC Rotterdam improved from GOOD to VERY GOOD due to the replacement of a new energy-efficient air handling installation. The figure below shows all the certificates obtained per asset.

Pipeline projects, Hourglass (Amsterdam) and Central Park (Utrecht), which are currently under development, will both receive a BREEAM-NL Excellent certificate upon delivery.

Sustainable building certificates

BREEAM scores (% of lettable floor space)

Targets on sustainable buildings & Investments |

All standing investments minimum BREEAM-NL in-use VERY GOOD by the end of 2020 | On track. 55.1% certified minimum VERY GOOD. (2017: 55,1%) |

Acquisitions and major renovations/ redevelopments minimum BREEAM-NL VERY GOOD | On track. Aquisitions of development projects Hourglass (Amsterdam) and Central Park (Utrecht) inlude a BREEAM NL EXCELLENT certificate.

Redevelopment projects Building 1931 and Building 1962 (Amsterdam) will receive BREEAM-NL GOOD certificates as of delivery in 2019, after which we will aimed for a BREEAM-NL In-Use VERY GOOD certificate through (necessary and agreed) close cooperation with tenants. |

The Fund redefined these targets in the Fund Plan 2019-2021 in such a way that we are now aiming for 100% certified assets with BREEAM-NL In-Use GOOD labels at Building Management level by the end of 2021, while we have so far focused solely on certification at asset level.

Reduction of environmental impact

We are committed to making environmental stewardship an integral part of our daily operations and strive to reduce both our direct and indirect environmental footprint. Energy consumption accounts for a large proportion of a building’s environmental footprint. Data measurement and consistent reporting via certification schemes help us to improve our buildings’ energy efficiency and reduce the associated costs, in cooperation with our tenants. We have adopted maintenance strategies that include modern, energy-efficient heating, cooling and lighting systems.

Energy efficiency is the most cost-effective way for the Fund to reduce carbon emissions, but we also encourage the use of renewable energy sources. We buy certified green electricity and are boosting alternative energy use.

The Office Fund's sustainability strategy is focused on reducing the environmental impact of the office assets in its portfolio. It does this by exerting a direct influence on the larger (public) areas of the buildings or complexes, and by investing in improvements that benefit existing and potential tenants. The Fund actively cooperates with existing tenants and potential tenants on initiatives to optimise comfort and energy efficiency. We also work closely with external property managers to provide comfortable, safe and convenient office and public spaces in assets.

Sustainability improvements

In 2018, the Fund initiated (and executed) several projects aimed at improving the sustainability of the Fund and reducing the environmental impact of its assets. These included the development of a new geothermal heating and cooling storage system (WKO) for Centre Court (The Hague) and the installation of new solar panels for Maasparc (Rotterdam), WTC Rotterdam and Centre Court (The Hague).

One of the biggest dilemmas the Fund shares with other real estate investors on the sustainability front is deciding how to invest, how much to invest and what technologies or innovations to invest in to create the most sustainable portfolio possible, both in terms of positive environmental and social impact and in terms of sustainable long-term returns on our investments. This dilemma, which translates into a constant stream of choices and decisions, informs virtually everything we do to make the Fund and the office portfolio more sustainable. Every decision related to investments in energy-saving, GHG emissions reduction or positive social impact has to be balanced against our primary goal, which is to generate healthy long-term returns for our shareholders and their stakeholders. We want the Fund and our assets to be as sustainable as they can be, but how much we can invest is always limited by the potential impact on returns.

On top of this is the question of how to invest, which can be about finding the best ways to reduce our environmental impact or having a positive commercial or social impact both effectively and cost-efficiently. For instance, should we install solar panels or link up our office assets to energy-efficient thermal energy storage systems for heating and cooling? And when is either or both of these measures even feasible for some assets? And they are not, what are the alternatives? And how quickly should we execute the phased introduction of LED lighting systems in our buildings? During renovations, or as separate projects? How many of our building can we fit with a green roof or where can we introduce green communal areas? This in turn raises the question of whether our office tenants will be willing to co-invest in the form of slightly higher rents in exchange for lower energy bills. Or other forms of co-investment? Another question is what is the best way to work with developers to maximise the sustainability of our new-build projects? Or with construction firms when we upgrade existing office assets? We firmly believe that cooperation with our stakeholders will be the key to our success on this front.

Monitoring performance

The single biggest challenge to enhanced energy efficiency, improved indoor air quality and the streamlined management of buildings is how to analyse and use building big data effectively. Our environmental data management system combines extensive industry expertise with state-of-the-art building analytics software to create smarter buildings. The platform combines different data streams in one online portal, which provides a picture of the entire footprint related to energy, water and waste. In 2018, the Fund completed the implementation for the whole portfolio. This Environmental Data Management System will also provide significant input for the 2019 GRESB survey.

Monitoring environmental performance data (energy and water consumption, greenhouse gas emissions and waste) is an important part of managing sustainability issues. The Fund tracks and aims to improve the environmental performance of its managed real estate assets: those properties for which the Fund is responsible for purchasing and managing energy consumption. The Fund reports on energy consumption (electricity, heating and gas: the energy components) for multi-tenant assets, which translates to greenhouse gas emissions.

The Fund has set clear targets for the reduction of its environmental impact in the period 2018-2020:

Renewable energy: increase percentage of renewable energy

Energy: average annual reduction 2%

GHG emissions: average annual reduction 2%

Water: average annual reduction 2%

Waste: Increase recycling percentage

Renewable energy production

In 2018, we initiated the development of a new geothermal heating and cooling system for Centre Court (The Hague). Realisation and completion is planned for Q3 2019. This system will help reduce CO2 by cutting the use of central district heating. For WTC Rotterdam, Centre Court (The Hague) and Maasparc (Rotterdam), we commissioned the installation of solar panels and expect this to be completed in Q1 2019.

Energy consumption and GHG emissions

In 2018, the Fund's energy consumption rose with 0.3% (2017: 1.1%) on a like-for-like basis.

Water consumption

We take a strategic approach to water management because this enhances the efficiency, resilience and long-term value of our investments. The Fund is committed to reducing water consumption, reusing water and preventing water pollution and flooding.

The Fund has been actively tracking water consumption in multi-tenant assets since 2012. Data is provided by the property manager and is based on invoices and manual visual readings. Renovations always include the installation of water-efficient sanitary installations.

We have implemented a measure to prevent flooding at WTC The Hague. The courtyard adjacent to the central entrance area, which is also the roof of the parking garage, has been designed as a 'Polderdak'. Numerous boxes on the roof function as water storage: they hold rainwater in a such a way that it reduces pressure on the drainage system. After heavy rainfall, the water can still be released through the drainage system or the water may simply vaporise.

Waste

The Fund aims to manage waste at its properties responsibly. We encourage our tenants to minimise and recycle waste. We provide recycling bins and encourage the reuse of plastics, metal and other materials. We are also studying the opportunities offered by circular economy developments. The Fund tracked waste management for its entire managed real estate portfolio in 2018. The focus is on those assets for which the Fund is responsible and can influence the waste handling on-site and generally involves multi-tenant office assets. No waste is sent directly to landfill.

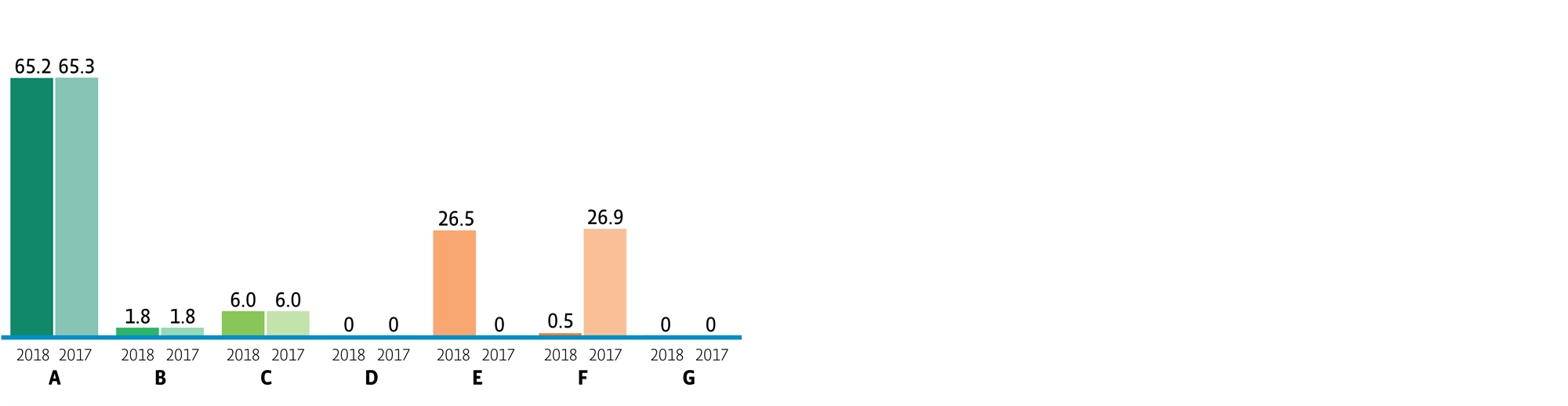

Investment property by labelled floor space (m²) in %

Green portfolio

Another target related to the Fund's sustainability at asset level is to achieve a 100% green portfolio (EPC label A, B or C) in 2018 (excluding listed buildings). The distribution of energy labels in the portfolio is shown below. Investment properties under construction, in this case Building 1931,Building 1962,Hourglass (all in Amsterdam) and Central Park (Utrecht) are excluded from this overview. The Fund expects these to receive an energy label A upon their delivery in 2019 and2020 respectively. The energy label E relates to WTC Rotterdam. Improving the energy efficiency of this asset is more difficult than for other assets due to the listed status of a part of the building. The Fund is currently drawing up a tailor-made improvement plan for this asset. We obtained energy label A for the high-rise section. In 2019, we will start with the renovation of the façade for the listed low-rise section and we expect to obtain an energy label B after completion, which is foreseen for 2020.

Targets on reduction of environmental impact |

Doubling energy generated on location in 2020 compared to 2016 (182 kWp) | On track. At the end of 2018, 224 kWp |

Reduce average annual environmental impact with 2% per year | Energy 0.3% increase |

GHG emissions 0.7% increase |

Water - 7.0% |

Waste + 17.2% |

100% green portfolio (A, B, C energy labels) in 2018 | 73%

|

The Fund redefined these targets in the Fund Plan 2019-2021 in such a way that we are now aiming to receive Energy label A for at least 75% of the portfolio (energy-index <1.2). The target for energy reduction is now 5% per year to put the target in line with (international) climate goals (reduction of 95% of CO2 in 2050 compared to 1990). We also raised the target for renewable energy generated on-site via solar panels to 750 KWp by the end of 2021.